With the festive season upon us, consumers across India must be gearing up for a shopping spree like no other. And what makes it even more enticing is the plethora of credit card rewards and points being offered by leading financial institutions like HDFC Bank, State Bank of India (SBI), ICICI Bank and others. This year, it's not just about the festivities; it's also about the ICC World Cup 2023, adding an extra layer of excitement to the season.

Live TV

Loading...

However, it's essential to recognise that individuals' credit card requirements can differ significantly. Travel cards, for instance, frequently offer discounts on dining and accommodations, allowing cardholders to escape the holiday season rush and even mitigate the elevated prices that often accompany peak seasons. Conversely, shopping and cashback cards provide substantial discounts and rewards for both online and offline purchases, covering a wide range of consumer goods, from electronics to clothing.

Lifestyle cards, on the other hand, are geared toward enhancing dining experiences and making celebrations more enjoyable, while they also extend discounts to various lifestyle expenses, including subscriptions, which can serve as thoughtful festive gifts.

Let's look at some of the credit cards that can elevate the festive season shopping experience:

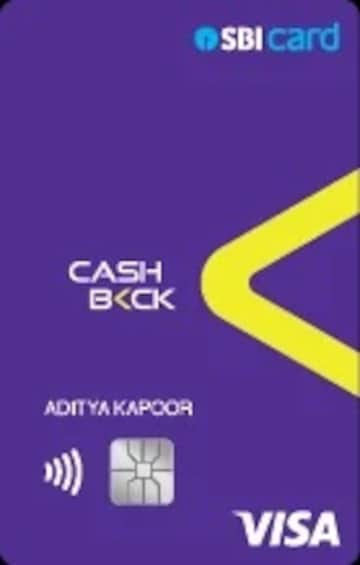

Cashback SBI card

The Cashback SBI Card is considered one among the best cashback credit cards available. It offers unlimited cashback on both online and offline transactions. With 5% cashback on all online spends and 1% cashback on other expenses, it ensures substantial savings for cardholders. What sets this card apart is its lack of merchant restrictions, making it ideal for online shopping, according to Paisabazaar, a digital consumer credit marketplace.

(Source: Paisabazaar)

Although it excels in online spending, it doesn't offer significant benefits on utility payments and fuel transactions.

Annual Fee: ₹999

Renewal Fee: ₹999 (Waived if one spends ₹2 lakh in a year)

Who should use it?

This can be a choice for customers who frequently make online purchases that are not limited to select brands, Paisabazaar mentioned.

SimplyCLICK SBI card

The SimplyCLICK SBI Card can be another choice for shoppers looking to make the most of the festive season. It offers a range of rewards, including an Amazon.in gift card worth ₹500 upon joining, 5x rewards on online spends, and 10x rewards at exclusive partners like Amazon, Zoomcar, and Lenskart.

(Source: SBI Cards)

What makes this card particularly attractive is its e-vouchers worth ₹2,000 on reaching annual spending milestones. Additionally, the annual fee of ₹499 can be reversed by spending ₹1 lakh in a year. The card's partnership with various brands and services like UrbanClap makes it a valuable asset during the festive season, as per Paisabazaar.

Who should use?

Those looking for simple eligibility and low annual fee can go for this.

HDFC MoneyBack+ credit card

The HDFC MoneyBack+ Credit Card can be a choice for first-time credit card users. With up to 10x reward points on select brands such as Amazon, Flipkart, Swiggy, and more, it's perfect for those who frequently shop online. This card also offers 5x reward points on EMI spends at select merchants, as per Paisabazaar.

(Source: Paisabazaar)

The reward points earned with this card can be redeemed as cashback, providing significant savings for cardholders. However, it doesn't offer exclusive benefits in the travel category, such as complimentary lounge access.

Who should use it?

It's best suited for online shoppers who want to make the most of their spending.

Amazon Pay ICICI credit card

For frequent Amazon shoppers, the Amazon Pay ICICI Credit Card is a must-have during the festive season. Prime members enjoy 2% higher cashback on Amazon purchases, making it a great incentive to subscribe to Amazon Prime. This card offers 2% cashback on Amazon purchases and 1% cashback on all other transactions.

(Source: Paisabazaar)

The card's lifetime free status and a wide range of partner merchants make it one of the best online shopping credit cards in India.

Who should use it?

It's particularly advantageous for those who regularly shop on Amazon and want to maximise their savings, as per Paisabazaar.

HDFC Millennia credit card

Designed for millennials, the HDFC Millennia Credit Card offers up to 5% cashback for online transactions and 1% cashback on offline spends. While it comes with an annual fee of ₹ 1,000, the benefits are worth it if you're a regular online shopper, Paisabazaar said.

Who should use?

With accelerated rewards on brands like Amazon, BookMyShow, Flipkart, and more, it's a great choice for those who shop across a range of online platforms. However, to fully benefit from this card, you'll need to meet minimum transaction limits, which might be a drawback for some users.

Axis Bank ACE credit card

The Axis Bank ACE Credit Card offers a high cashback of 2% on all transactions and up to 5% cashback on bill payments, DTH, and mobile recharges via Google Pay.

Who should use?

This card is ideal for those looking for straightforward benefits and high cashback rates, Paisabazaar said.

(Edited by : Shoma Bhattacharjee)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court dismisses plea seeking postponement of CA exams; details here

Apr 29, 2024 2:29 PM

Just 8% women candidates contested first two phases of Lok Sabha polls

Apr 29, 2024 12:00 PM

The sexual assault case against Prajwal Revanna — here's what we know so far

Apr 29, 2024 11:36 AM

Repolling underway at one polling booth in Chamarajanagar LS segment in Karnataka

Apr 29, 2024 10:32 AM