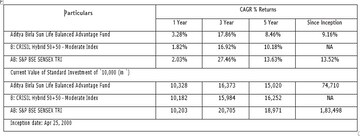

Since its inception on April 25, 2000, Aditya Birla Sun Life Balanced Advantage Fund has registered a 9.16 percent compound annual growth rate (CAGR). The value of Rs 10,000 via Systematic Investment Plan (SIP) became Rs 1.14 crore in the last 23 years, the fund house said in a statement.

Live TV

Loading...

About the fund

Aditya Birla Sun Life Balanced Advantage Fund is an open ended dynamic asset allocation fund. This is a kind of hybrid fund, which changes its asset allocation i.e. equity and fixed income allocations, dynamically according to market conditions.

As per the fund house, the fund managers invest into opportunities available across the market capitalisation. They use top down approach to identify growth sectors and bottom up approach to identify individual stocks.

"The fund has the flexibility to invest in stocks across different market capitalization. The fund would therefore contain a blend of large, mid and small cap stocks. The allocation to the different market caps would vary from time to time depending on the overall market conditions, market opportunities and the fund manager's view. The fund benchmark is CRISIL Hybrid 50+50 - Moderate TRI," the AMC said.

The fund has asset under management (AUM) of Rs 6,276 crore as on March 31, 2023 and an expense ratio of 0.42 percent. The net asset value (NAV) stands at Rs 76.87 as on May 2, 2023.

Fund's top 5 holdings are in Reliance Industries Ltd, ICICI Bank Ltd, Bharti Telecom Ltd, HDFC Bank Ltd and Infosys Ltd..

The fund managers

The fund managers are Mohit Sharma, Vishal Gajwani and Lovelish Solanki since April 1, 2017, April 1, 2022 and October 09, 2019 respectively. While Sharma has a total experience of over 15 years, Solanki comes with an experience of over a decade in fund management and research, both in equity and debt.

With over 15 years of experience in equity research and portfolio management, Gajwani has experience of managing equity portfolios across investment cycles.

Scheme performance summary

(Source: Aditya Birla Capital)

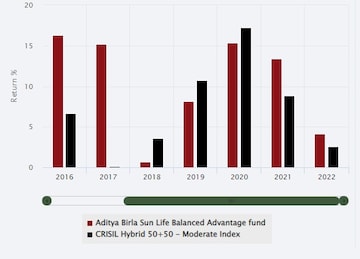

(Source: Aditya Birla Capital)Annualised returns

(Source: Aditya Birla Capital)

Investment strategy

Aditya Birla Sun Life Balanced Advantage Fund adopts a ‘dynamic’ approach to asset allocation. This involves negotiating the ups and downs of the market cycle. Essentially, it aims to buy into underpriced opportunities, and sell out of overpriced situations. As per the fund house, the fund provides particular comfort to investors who seek smoother returns over the long-term.

"While being invested in long equity at all times, it uses derivatives to reduce the ‘net’ exposure to equities, allowing fundamental research driven approach to selection of stocks that continue adding alpha over a longer period of time. The fund also gets the added advantage of equity taxation since its gross equity exposure is 65 percent and above," it said.

Other advantages that run in favour of the fund is that it participates in growing stocks and limits investments in low yield stocks. It endeavours to declare dividends under Income Distribution cum Capita Withdrawal (IDCW) option, subject to availability of distributable surplus, the AMC said.

Talking particularly about the balance advantage funds, experts say that they have the ability to contain the downside using different strategies and is likely to give decent returns with much less volatility.

ALSO READ | AMFI advisory against linking distributor training programmes to achieve SIP sales targets

First Published: May 3, 2023 12:37 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM