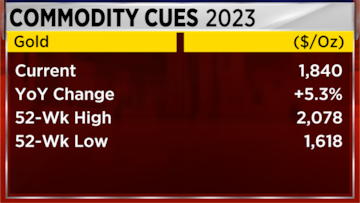

Swiss Asia Capital, an investment management firm, is currently in "accumulation mode" when it comes to gold, which means that the firm is actively buying and holding onto gold as a long-term investment strategy. Prices of many commodities, from metals to grains have come off their 2022 highs.

Metals have been hounded by doubts over China's pace of growth, while off the post-Ukraine war highs are still close to all-time highs in part due to El Nino fears. The resultant inflation fears are for all to see, which is more and more rate hikes expected from the Fed and it can be seen in US bond yield rates.

In an interview with CNBC-TV18, Juerg Kiener, MD and CIO of Swiss Asia Capital said that gold is poised to make new highs soon, which makes it an attractive asset to hold onto. Kiener has been following the commodity space for many years.

He said, “We are in accumulation mode. The government is accumulating record speeds of precious metal because they want to reduce the counterparty risk and we will see it continue.”

“Gold is going to make new highs by December 2023 and the market can start finding its own way to higher levels,” he added.

Kiener expressed concern about the counterparty risk associated with holding gold. Therefore, to mitigate this risk, his firm is looking for ways to reduce its exposure to counterparties when it comes to gold transactions. This is an important consideration for any investor who wants to protect their assets and minimize risk.

The derivative book is currently dictating the price of gold, which means that the price of gold is being influenced by factors beyond just supply and demand.

Kiener said that this situation is likely to change in the future, as the market for gold continues to evolve and become more transparent.

Kiener said that the market will eventually liberalise gold prices, which would be a major development for the industry. This would allow investors to buy and sell gold at market-determined prices without having to worry about the influence of derivative books or other factors.

Talking about silver, he said that it has the potential to move above $25-26 per ounce soon. While silver has historically been a more volatile asset than gold, Kiener said that there is a lot of potential for silver as well.

For more details, watch the accompanying video