The first tranche of Sovereign Gold Bond (SGB) scheme for 2023-24 is currently available for subscription and shall be there till Friday i.e. June 23. The price for this bond has been fixed at Rs 5,926 per gram of gold, with Rs 50 discount for those who invest online. Experts call SGB a decent investment due to factors like government guarantee, interest of 2.5 percent and capital gains tax exemption if held for the full 8 years.

Live TV

Loading...

However, it makes sense to see if SGB has worked well for investors in the past.

Here's a look at how SGB performed since the start of FY22:

| FY22 and FY23 | Issue Date | Issue Price (Rs) | Current Price (Rs) | Returns |

| 2021-22, Series I | May 25, 2021 | 4,777 | 5,926 | 24.05% |

| 2021-22, Series II | June 1, 2021 | 4,842 | 5,926 | 22.39% |

| 2021-22, Series III | June 8, 2021 | 4,889 | 5,926 | 21.21% |

| 2021-22, Series IV | July 20, 2021 | 4,807 | 5,926 | 23.28% |

| 2021-22, Series V | August 17, 2021 | 4,790 | 5,926 | 23.72% |

| 2021-22, Series VI | September 7, 2021 | 4,732 | 5,926 | 25.23% |

| 2021-22, Series VII | November 2, 2021 | 4,761 | 5,926 | 24.47% |

| 2021-22, Series VIII | December 7, 2021 | 4,791 | 5,926 | 23.69% |

| 2021-22, Series IX | January 18, 2022 | 4,786 | 5,926 | 23.82% |

| 2021-22, Series X | March 8, 2022 | 5,109 | 5,926 | 15.99% |

| 2022-23, Series I | June 28, 2022 | 5,091 | 5,926 | 16.40% |

| 2022-23, Series II | August 30, 2022 | 5,197 | 5,926 | 14.03% |

| 2022-23, Series III | December 27, 2022 | 5,409 | 5,926 | 9.56% |

| 2022-23, Series IV | March 14, 2023 | 5,611 | 5,926 | 5.61% |

(Source: RBI)

The above data has used price of SGB for the first issue of FY24 as the benchmark price to calculate returns. The above table shows that had an investor bought gold bonds in any of the tranches in the last 14 issues in FY21 and FY22, he/she would be sitting on profits.

"One can argue that 2 years is a very short period. But, if we take from the time SGBs were launched by the government in 2015, the price of the gold bonds is up 121 percent. That is CAGR yield of 12 percent and if we add the interest of 2.5 percent, it makes the yield 14.5 percent," said Nehal Mota, Co-Founder & CEO at Finnovate, Hybrid Financial Fitness Platform while talking to CNBC-TV18.com.

On the other hand, if we look at gold prices, they have gained over 17 percent in FY23, around 8.2 percent YTD. Gold prices have been trading near their all-time highs domestically as well as globally. The recent moves by the US Fed and RBI capped gains for gold, leading to softness in the prices.

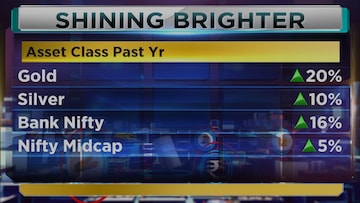

Here's a look at how gold fared last year versus other asset class:

Moving forward, Nish Bhatt, Founder & CEO at Millwood Kane International believes that gold prices will be guided by the action of the central banks, DXY a possible chance of a recession in the US, and the geopolitical situation between Russia-Ukraine and China-Taiwan.

"Expectations of global central banks easing rates from CY24 onwards will provide support to the yellow metal," he said.

Given this, can we say SGB is a decent avenue?

The returns of SGB shows it's an attractive investment as per conservative asset class. One can also look at other benefits of gold bond.

If held till maturity, SGB gives zero taxation and even if sold earlier investors can get the benefit of long-term capital gains with indexation (> 3 year holding period). Additionally, it offers a semiannual interest rate of 2.5 percent per annum (though taxable it still is an added income that neither a fund or physical gold provides)

"These bonds are also tradable on the exchange and some series do have reasonable liquidity at least for retail investors. With the current movement of gold over the past 1 year, people have been flocking to buying SGB's, however we advise individuals not to take an exposure of more than 10 percent into gold as an asset class as over long periods it is a cyclical commodity and returns are generally lower vs equities," Vivek Banka, Co-Founder at GoalTeller told CNBC-TV18.com.

Seconding Banka's thought, Mota of Finnovate also suggests investors to look at gold as a hedge and not as a return generating investment. Hence the percentage allocation is critical (and here we only talk about investments in gold and not jewellery).

"If one is still under that ratio, this is the time to buy SGBs. It is essential to ensure that investors don’t overshoot that allocation percentage too much," he said.

Buying SGB from secondary market

SGBs are issued in tranches and generally open for a period of one week in a month. But, investors actually don't need to wait for the Reserve Bank of India (RBI) to issue fresh SGBs. This is because they are always available on the secondary market and one can buy them via stock exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Via exchanges, investors are likely to get SGBs at discounted rates. This disparity mainly results from the exceedingly low trading volumes on the stock exchanges.

The forces of supply and demand determine the prices of SGBs exchanged on the secondary market, just like they do for any other active public security. Besides the fact that there isn’t a lot of liquidity for these securities, demand and supply dynamics also matter. These elements cause the SGB bond prices to diverge from gold spot prices, according to ICICI Direct.

(Edited by : C H Unnikrishnan)

First Published: Jun 20, 2023 2:18 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM