The contributions to systematic investment plans (SIPs) – where investors make periodic, equal payments into a mutual fund – dropped in February. The SIP stoppage ratio, which relates to the closed SIPs accounts, rose to 27-month high of 0.68 in February, according to the data released by the Association of Mutual Funds in India (AMFI). This was even higher than the average stoppage ratio of 0.51 percent.

Live TV

Loading...

If we look at the account addition numbers in February too, it came in at 6.6 lakh only, which is an eight-month low.

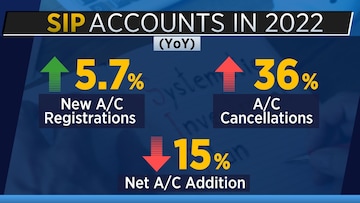

The yearly figures too look a bit disappointing. In 2022, new account registrations were up 5.7 percent at 2.57 crore. The cancellations, on the other hand, saw a big jump of 36 percent versus 2021 which was at 1.36 crore.

With this, the net SIP account addition was down 15 percent from what we saw in 2021 and stood at 1.22 crore.

With this, the net SIP account addition was down 15 percent from what we saw in 2021 and stood at 1.22 crore.

So, does this mean that SIP is losing its sheen?

According to market experts, the reason for account closing could be the trailing equity market returns.

In an exclusive conversation with CNBC-TV18.com, Abhishek Dev, Co-Founder and CEO at Epsilon Money Mart said, "Investors must be sceptical about investing in the market due to higher volatility and lower returns recently over the past year or so. The fear from such short medium term volatility may have resulted in the decline of SIPs number."

Markets have lately remained volatile amid global and domestic cues.

The other reason, which Dev thinks, could be an increase in interest rates in the economy in the past months.

"This has made debt-oriented instruments relatively attractive among low-risk investors," Dev told CNBC-TV18.com.

In a high-interest regime, debt funds start investing in the newer bonds offering a high-interest coupon and may get captivating. Also, investors consider debt funds as a cushion in periods of significant market volatility.

However, experts think that investors should continue with their SIPs in any situation. The answer to that is: SIPs are designed exactly to deal with the kind of volatility that is being witnessed in the market now.

SIPs average out the risk of equity investment over a period of time. This phenomenon is called rupee cost averaging. It allows investors to buy more units of a mutual fund when the market is low and reduce the per-unit cost of investment.

Markets tend to go in cycles, stimulated by emotions of greed and fear. But over time, stocks tend to converge with their true earnings potential. What that means is investing in SIPs for long periods would result in a purchase of stocks at various valuations, which would average out to mean.

"SIPs are a long-term investment option and investors should focus more on long-term returns rather than short-term fluctuations. Rather than stopping SIP one must continue it with discipline, looking at it as an opportunity to invest at discounted prices. During the last 20 years, SIPs have provided an average return of 14.83 percent, meaning if someone did a SIP of Rs 25,000 per month for 20 years he/she would’ve built a corpus of approximately Rs 3.37 crore (NJ internal data, 2022). Hence, SIP is an evergreen investment medium and its shine will never fade in the long run," Misbah Baxamusa, CEO at NJ Wealth Financial Products Distributors Network told CNBC-TV18.com.

At times, millennials face a unique set of challenges when it comes to investing in SIPs. That may result in lower numbers too.

"By taking steps to increase financial literacy, managing their debt, and investing regularly, they can overcome these challenges and secure their financial future," said Yashoraj Tyagi, CTO and CBO at CASHe.

(Edited by : Abhishek Jha)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | What does a low voter turnout indicate for NDA and I.N.D.I.A Bloc

Apr 29, 2024 5:48 AM

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM