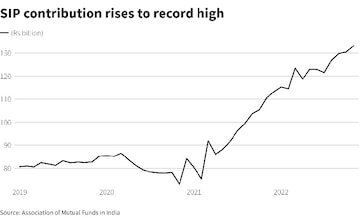

The contributions to systematic investment plans (SIPs) – where investors make periodic, equal payments into a mutual fund – rose for the fifth consecutive month to a record Rs 13,573 crore in December, according to the data released by the Association of Mutual Funds in India (AMFI). However, the data also suggests that cancellations of SIPs have also reached to 25-month high which is concerning, experts say.

First, let's look at contributions in detail

For the third straight month, the SIP flow was above Rs 13,000 crore mark. The inflows through SIPs have been above the Rs 12,000-crore mark since May. It was at Rs 12,140 crore in July, Rs 12,276 crore in June and Rs 12,286 crore in May. Before that, it was at Rs 11,863 crore in April.

According to the industry body, the

number of SIP accounts stood at 6.12 crores for the month of December 2022, compared to 6.05 crores as of November, 2022. The SIP assets under management (AUM) stood at Rs 6.75 crore for December.

About 90 percent of the total SIP inflows were into equity schemes, AMFI chief executive N S Venkatesh said.

Now, let's look at the key reasons for this recent rise

The increase in the amount of SIP collected shows that retail investors are taking a disciplined approach to their mutual fund investment.

"The importance of investing in equity markets for the longer term goals is not lost on investors and the same is reflected in the ever-increasing awareness and adoption of SIP as a goal-linked route to create wealth over the long term. This month almost 24 lakh new SIPs were registered, which shows increasing investor belief in the instrument," AMFI's Venkatesh said.

Akhil Chaturvedi, Chief Business Officer at Motilal Oswal AMC said that SIPs creating new milestones highlights the strong domestic flows which has also helped to negate the recent selling by FIIs.

Sanjiv Bajaj, Jt. Chairman & MD at Bajaj Capital Ltd. attributes this increase to the increasing awareness and adoption of SIPs as a long-term investment option.

Month-wise amounts collected from FY16-17 are mentioned below:

| Month | | SIP contribution in crore |

|---|

| | FY 2022-23 | FY 2021-22 | FY 2020-21 | FY 2019-20 | FY 2018-19 | FY 2017-18 | FY 2016-17 |

| Total during FY | 87,275 | 1,24,566 | 96,080 | 1,00,084 | 92,693 | 67,190 | 43,921 |

| March | | 12,328 | 9,182 | 8,641 | 8,055 | 7,119 | 4,335 |

| February | | 11,438 | 7,528 | 8,513 | 8,095 | 6,425 | 4,050 |

| January | | 11,517 | 8,023 | 8,532 | 8,064 | 6,644 | 4,095 |

| December | | 11,305 | 8,418 | 8,518 | 8,022 | 6,222 | 3,973 |

| November | | 11,005 | 7,302 | 8,273 | 7,985 | 5,893 | 3,884 |

| October | 13,041 | 10,519 | 7,800 | 8,246 | 7,985 | 5,621 | 3,434 |

| September | 12,976 | 10,351 | 7,788 | 8,263 | 7,727 | 5,516 | 3,698 |

| August | 12,693 | 9,923 | 7,792 | 8,231 | 7,658 | 5,206 | 3,497 |

| July | 12,140 | 9,609 | 7,831 | 8,324 | 7,554 | 4,947 | 3,334 |

| Jun | 12,276 | 9,156 | 7,917 | 8,122 | 7,554 | 4,744 | 3,310 |

| May | 12,286 | 8,819 | 8,123 | 8,183 | 7,304 | 4,584 | 3,189 |

| April | 11,863 | 8,596 | 8,376 | 8,238 | 6,690 | 4,269 | 3,122 |

Then why cancellations?

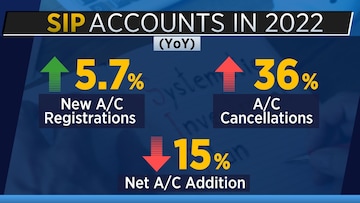

In 2022, new account registrations were up 5.7 percent at 2.57 crore. The cancellations, on the other hand, saw a big jump of 36 percent versus last year at 1.36 crore. With this, the net SIP account addition is down 15 percent from what we saw in 2021 and has come in at 1.22 crore.

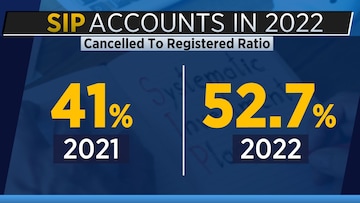

Another point to track is the SIP cancelled to registered ratio. There has been a big jump here as well at 52.7 percent for 2022 versus 41 percent in 2021.

This ratio was particularly high in December. It came in at 66 percent which is a 25-month high level. In fact for the past year, this ratio has stayed above the 50 percent mark for 7 out of 12 months. So while the SIP contribution looks good, there is more to read in the data at least on the account front.

Sriram B.K.R., Senior Investment Strategist at Geojit Financial Services said that cancellations of SIP is a reason of concern.

"However, there were instances of lower net additions seen in some months even in the past. So, the overall trend seems to be getting stable," he added.

Going forward, he thinks that challenges would be on, above average redemptions induced either by profit booking or heightened volatility and cancellation of SIPs.

"Market falls or fluctuations for months in a row can be perplexing at times, but what we have seen in equities is that it rewards those with discipline and patience handsomely in the long term. Investors should continue their SIPs through the market volatility in order to reap the fullest gains of this whole systematic approach of investing in equities," he suggested.

SIP is an investment plan (methodology) offered by Mutual Funds wherein one could invest a fixed amount in a mutual fund scheme periodically at fixed intervals — say once a month instead of making a lump-sum investment.

The SIP instalment amount can be as small as Rs 500 per month.

SIP has been gaining popularity among Indian MF investors, as it helps in rupee cost averaging and investing in a disciplined manner without worrying about market volatility and timing the market.

The rupee cost-averaging feature of SIP allows investors to buy more units of a mutual fund when the market is low and reduce the per-unit investment cost.

First Published: Jan 11, 2023 9:46 AM IST