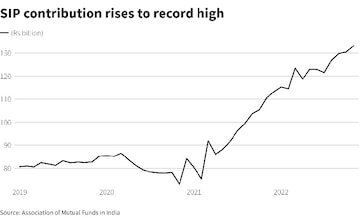

The contributions to systematic investment plans (SIPs) – where investors make periodic, equal payments into a mutual fund – rose for the sixth consecutive month to a record Rs 13,856 crore in January 2023, according to the data released by the Association of Mutual Funds in India (AMFI). The mutual fund SIP accounts went up to 6.22 crores, compared to 6.12 crores in December.

Live TV

Loading...

For the fourth straight month, the SIP flow was above Rs 13,000 crore mark.

The SIP assets under management (AUM) stood at Rs 6.73 crore for January. The new SIP registered for the month of January 2023 stood at 22.65 crores.

Let's look at the key reasons for this rise

N S Venkatesh, Chief Executive at AMFI said that encouraging SIP numbers indicates retail investors’ trust in mutual funds.

"We believe that SIP inflow momentum has and will continue to balance the FII outflows in the market. The importance of investing in equity markets for the long term goals through SIP as a goal-linked route to create wealth is gaining awareness. This month almost 23 lakh new SIPs were registered, which shows increasing investor belief in the instrument. SIPs are the simplest route to build a disciplined habit of regular investing," he said.

Echoing the same views, Manish Mehta, Head - Sales, Marketing and Digital Business at Kotak Mahindra Asset Management Company Ltd said that SIP flow continues to be encouraging as investors see merit in the long-term benefits of SIPs.

"Investors seem to be maintaining their asset allocation of adding funds on dips. This is also a reflection of the excellent work done by mutual fund distributors and industry to promote disciplined investment," Mehta said.

Month-wise amounts collected from FY16-17 are mentioned below:

| Month | SIP Contribution ₹ crore | ||||||

|---|---|---|---|---|---|---|---|

| FY 2022-23 | FY 2021-22 | FY 2020-21 | FY 2019-20 | FY 2018-19 | FY 2017-18 | FY 2016-17 | |

| Total during FY | 1,28,010 | 1,24,566 | 96,080 | 1,00,084 | 92,693 | 67,190 | 43,921 |

| March | 12,328 | 9,182 | 8,641 | 8,055 | 7,119 | 4,335 | |

| February | 11,438 | 7,528 | 8,513 | 8,095 | 6,425 | 4,050 | |

| January | 13,856 | 11,517 | 8,023 | 8,532 | 8,064 | 6,644 | 4,095 |

| December | 13,573 | 11,305 | 8,418 | 8,518 | 8,022 | 6,222 | 3,973 |

| November | 13,306 | 11,005 | 7,302 | 8,273 | 7,985 | 5,893 | 3,884 |

| October | 13,041 | 10,519 | 7,800 | 8,246 | 7,985 | 5,621 | 3,434 |

| September | 12,976 | 10,351 | 7,788 | 8,263 | 7,727 | 5,516 | 3,698 |

| August | 12,693 | 9,923 | 7,792 | 8,231 | 7,658 | 5,206 | 3,497 |

| July | 12,140 | 9,609 | 7,831 | 8,324 | 7,554 | 4,947 | 3,334 |

| Jun | 12,276 | 9,156 | 7,917 | 8,122 | 7,554 | 4,744 | 3,310 |

| May | 12,286 | 8,819 | 8,123 | 8,183 | 7,304 | 4,584 | 3,189 |

| April | 11,863 | 8,596 | 8,376 | 8,238 | 6,690 | 4,269 | 3,122 |

(Source: AMFI)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Rapido offers free rides to voters to polling stations on May 13 in Hyderabad, 3 other cities

May 6, 2024 5:49 PM

Lok Sabha elections 2024: Seats to date, all you need to know about third phase of voting

May 6, 2024 4:49 PM

Concerns on low voter turnout a "myth"; absolute number of voters correct way to analyse: Report

May 6, 2024 2:57 PM

Haryana Lok Sabha elections 2024: A look at JJP candidates

May 6, 2024 2:26 PM