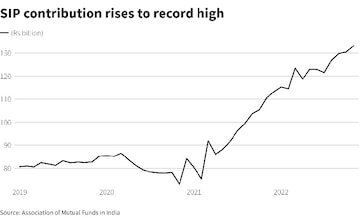

The contributions to systematic investment plans (SIPs) – where investors make periodic, equal payments into a mutual fund – rose for the fourth consecutive month to a record Rs 13,307 crore in November, according to the data released by the Association of Mutual Funds in India (AMFI). The mutual fund SIP accounts went up to 6.05 crores as of October 31, 2022, compared to 5.93 crores as of October 31, 2022.

Live TV

Loading...

For the second straight month, the SIP flow was above Rs 13,000 crore mark.

The SIP assets under management (AUM) stood at Rs 6.83 crore for November, when the number of new SIPs increased by 21.77 lakh.

The inflows through SIPs have been above the Rs 12,000-crore mark since May. It was at Rs 12,140 crore in July, Rs 12,276 crore in June and Rs 12,286 crore in May. Before that, it was at Rs 11,863 crore in April.

Let's look at the key reasons for this rise

The increase in the amount of SIP collected shows that retail investors are taking a disciplined approach to their mutual fund investment.

Akhil Chaturvedi, Chief Business Officer at Motilal Oswal Asset Management Company, thinks that SIP contribution remaining above Rs 13,000 indicates better awareness among retail investors about the long-term orientation of equity investments and wealth creation opportunities from India’s growth trajectory.

"Investors now see short-term volatility as part and parcel of equity investing. Instead of reading too much into a month-on-month dip in net equity inflows, the heartening thing to note is that net equity inflow has remained relatively resilient, and investors are willing to look past short-term trends and instead focus on long-term fundamentals," Chaturvedi said.

NS Venkatesh, chief executive officer at AMFI, believes that the healthy trend in SIP numbers will continue to grow.

This is because the interest of the retail investors in the markets is actually going up day by day, and the markets are also doing reasonably well.

Month-wise amounts collected from FY16-17 are mentioned below:

| Month | SIP contribution in crore | ||||||

|---|---|---|---|---|---|---|---|

| FY 2022-23 | FY 2021-22 | FY 2020-21 | FY 2019-20 | FY 2018-19 | FY 2017-18 | FY 2016-17 | |

| Total during FY | 87,275 | 1,24,566 | 96,080 | 1,00,084 | 92,693 | 67,190 | 43,921 |

| March | 12,328 | 9,182 | 8,641 | 8,055 | 7,119 | 4,335 | |

| February | 11,438 | 7,528 | 8,513 | 8,095 | 6,425 | 4,050 | |

| January | 11,517 | 8,023 | 8,532 | 8,064 | 6,644 | 4,095 | |

| December | 11,305 | 8,418 | 8,518 | 8,022 | 6,222 | 3,973 | |

| November | 11,005 | 7,302 | 8,273 | 7,985 | 5,893 | 3,884 | |

| October | 13,041 | 10,519 | 7,800 | 8,246 | 7,985 | 5,621 | 3,434 |

| September | 12,976 | 10,351 | 7,788 | 8,263 | 7,727 | 5,516 | 3,698 |

| August | 12,693 | 9,923 | 7,792 | 8,231 | 7,658 | 5,206 | 3,497 |

| July | 12,140 | 9,609 | 7,831 | 8,324 | 7,554 | 4,947 | 3,334 |

| Jun | 12,276 | 9,156 | 7,917 | 8,122 | 7,554 | 4,744 | 3,310 |

| May | 12,286 | 8,819 | 8,123 | 8,183 | 7,304 | 4,584 | 3,189 |

| April | 11,863 | 8,596 | 8,376 | 8,238 | 6,690 | 4,269 | 3,122 |

(Source: AMFI)

All about SIP

SIP is an investment plan (methodology) offered by Mutual Funds wherein one could invest a fixed amount in a mutual fund scheme periodically at fixed intervals — say once a month instead of making a lump-sum investment.

The SIP instalment amount can be as small as Rs 500 per month.

SIP has been gaining popularity among Indian MF investors, as it helps in rupee cost averaging and investing in a disciplined manner without worrying about market volatility and timing the market.

The rupee cost-averaging feature of SIP allows investors to buy more units of a mutual fund when the market is low and reduce the per-unit investment cost.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Just 8% women candidates contested first two phases of Lok Sabha polls

Apr 29, 2024 12:00 PM

The sexual assault case against Prajwal Revanna — here's what we know so far

Apr 29, 2024 11:36 AM

Repolling underway at one polling booth in Chamarajanagar LS segment in Karnataka

Apr 29, 2024 10:32 AM