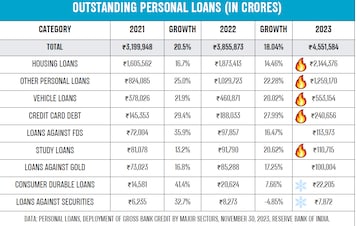

Retail lending surged by 18% year-on-year in 2023, with unsecured lending leading the charge, according to Bankbazaar's Moneymood 2023 report. Housing loans, representing a substantial 47% of the total lending, grew by 14%, while credit card, vehicle loans, and personal loans each surged by over 20%.

Live TV

Loading...

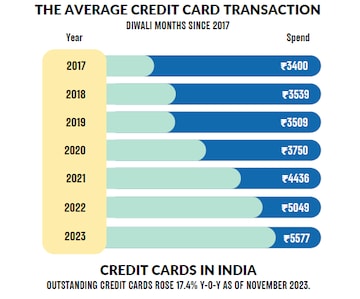

The proliferation of credit cards reached a milestone, with 94 million cards servicing an average transaction of ₹5,577, the report said.

Despite the prevailing high interest rates and inflationary trends, the demand for credit remained steadfasT.

Looking ahead to 2024, industry experts predict this high demand to persist as lenders recalibrate their strategies in response to new risk weight adjustments while eagerly anticipating potential interest rate cuts.

2023 trends and 2024 expectations

In 2023, the lending landscape saw a reshuffle in the retail credit pie.

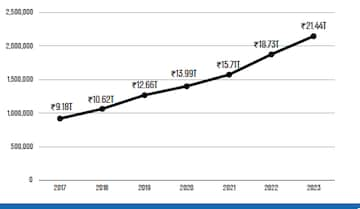

Home and vehicle loans experienced a slight dip, marking 59.27% of the pie, while personal loans and credit card dues increased to 32.95%. This shift contributed to the overall growth of the top four lending categories to a whopping ₹41.97 trillion.

(Source: Bankbazaar)

(Source: Bankbazaar)However, consumer durable loans experienced a slowdown.

Expectations for 2024 are cautiously optimistic. With hopes pinned on easing inflation, there's anticipation for a subsequent reduction in interest rates.

However, lending to high-risk, small-ticket segments might see constraints due to revised risk weightings, while prime borrowers continue to enjoy favourable loan terms, as per the report.

Interest rate trends

In 2023, the RBI maintained the repo rate at 6.50%, prioritising inflation management alongside growth support. Despite a gradual decline in inflation, supply chain disruptions led to persistent inflation spikes. However, the economy demonstrated resilience fuelled by robust domestic demand.

Looking ahead to 2024, the RBI projects a gradual decline in CPI inflation to 5.4%. However, the outlook remains cautious due to volatile food prices and commodity trends. Interest rates may remain stable or slightly higher as the RBI strives to reach the 4% mark while fostering economic growth.

Credit cards

In a year overshadowed by inflation, credit cards stood out in the unsecured credit landscape. Co-branded cards gained traction, supported by RBI policies enabling customers to choose network providers and expand credit cards to UPI.

The outstanding credit cards crossed 94.7 million, with spending hitting ₹1.79 trillion. Average spends per card increased by 10.4% to ₹5,577, with online spends per card also showing a significant uptick.

(Source: Bankbazaar)

However, expectations for 2024 suggest a potential slowdown in credit card growth due to increased risk weights. Yet, collaborations between fintechs and banks are expected to attract new users with tailored rewards and benefits.

Anticipating shifts in home loans and personal loans

Despite rising interest rates, home loans continued their upward trajectory, reflecting the persistent aspiration for homeownership. With real estate poised for growth post-pandemic, expectations for 2024 hinge on an interest rate reversal that could propel the housing market, Bankbazaar said.

(Source: Bankbazaar)

However, increased risk weights might tilt lending preferences towards prime borrowers.

On the other hand, the personal loan landscape, witnessing a steady rise in demand driven by innovative products, might face challenges due to heightened risk weights. The coming year could see a tug-of-war between maintaining high demand for small-ticket loans and lenders exercising caution, the report said.

(Edited by : Shoma Bhattacharjee)

First Published: Dec 22, 2023 6:58 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Exclusive | Full text of the PM interview: Modi's agenda for the next 5 years

Apr 29, 2024 10:28 PM

PM Modi says he’s going forward with a positive attitude as a response to personal attacks

Apr 29, 2024 10:08 PM