Home loan interest rates may start dropping before the end of 2023, experts said on Thursday after the Reserve Bank of India (RBI) maintained a status quo on the repo rate as well as its policy stance. Although inflation still remains higher than the tolerance level, it has decreased over the past few months, allowing the RBI to maintain its stance. Experts believe this status quo will facilitate positive decision-making for homebuyers and lenders.

Live TV

Loading...

Interest rates stabilising

Currently, the repo rate stands at 6.5 percent. This is the second incidence when the RBI paused the rate. This is good news for home loan borrowers as it signals that interest rates are stabilising. However, the best is yet to come when RBI starts cutting the rate.

Before hitting the pause button for the second time, the central bank has raised the repo rate cumulatively by 250 basis points since the beginning of the rate hike cycle in May 2022. For most banks, the external benchmark to which their home loans are linked is the repo rate. So, with the hike in repo rate, all existing home loans on floating rates of interest became expensive.

Ramani Sastri, Chairman and MD at Sterling Developers said the decision to keep the repo rate unchanged was a positive development as it provides home buyers and investors with some stability and reduces uncertainty and volatility associated with interest rate fluctuations.

"Another repo rate hike by the RBI would not augur well for the real estate sector as home loan interest rates are already at a higher level. Now, we expect a continuation of existing policy rates through 2023. Undoubtedly, a further reduction in interest rates in the near future would be preferred to bolster overall market confidence and make it more enticing for home buyers and support the growth momentum in the real estate sector," Sastri said.

Here's a look at the current home loan rates of key banks:

| Banks | Starting Interest Rate (p.a.) | Processing Fees |

| Kotak Mahindra Bank | 8.65% p.a. onwards | 0.50% |

| Citibank | 8.45% p.a. onwards | Rs. 10,000 |

| Union Bank of India | 8.70% p.a. onwards | - |

| Bank of Baroda | 8.60% p.a. onwards | Contact the bank for information |

| Central Bank of India | Contact the bank | Rs. 20,000 |

| Bank of India | 8.65% p.a. onwards | - |

| State Bank of India | 8.85% p.a. onwards | 0.35% onwards |

| HDFC | 8.60% p.a. onwards* | 0.5% or Rs.3,000 whichever is higher |

| LIC Housing Finance | 8.90% p.a. onwards | Rs. 10,000 -Rs. 15,000 |

| Axis Bank | 8.60% p.a. onwards | Rs. 10,000 |

(Source: Bankbazaar)

The road ahead

While experts are hinting at rate reductions in the near future, those expecting it in October should be disappointed.

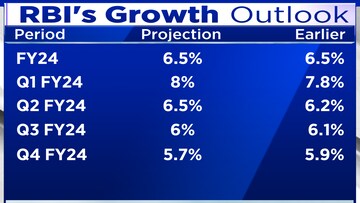

In an interview with CNBC-TV18, Kaushik Das, Chief Economist at Deutsche Bank said, "The consensus is for a 6 percent growth this year, RBI is for 6.5. But if RBI’s forecasts are met, then the logic for rate cuts get pushed back and probably in April of next year is when you could expect RBI to start cutting rates and we have a prolonged extended pause for now.”

Additionally, considering the prevailing circumstances, inflation still needs to be closely monitored to bring it down to 4 percent level, potentially prompting the RBI to reconsider its stance on interest rates and achieve a balance between growth and inflation.

As Das said, "We need to maintain Arjuna's eye on evolving inflation scenario”.

It must be noted that currently there is no indication from the RBI that the rate cycle will change anytime soon.

"The path thereon will be dependent on the evolving domestic inflation and growth dynamics and the US Fed stance," said Amit Jain, CMD at Arkade Group.

Additionally, the progress of monsoon would be keenly watched and would be one of the significant factors in deciding the direction of inflation.

What should borrowers do?

While borrowers are still reeling under the pressure of lengthening loan tenures and rising interest rates, Adhil Shetty, CEO at Bankbazaar.com, said that those on a repo-linked loan should automatically see a reset after any repo rate change within a quarter.

"The lowest rates being offered in the home loan market today are in the 8.40 percent to 8.50 percent range for eligible borrowers. Those who are paying a significantly higher rate should consider a refinance. If depositors are able to shave off 50 basis points or more off the rate, it could lead to significant savings over the long term," Shetty said.

He added that when individuals think about their home loans, they should also think about the premium they pay over the repo. For example, at 8.50 percent, the premium over the repo is 2 percent. Prime borrowers with good credit histories and strong income credentials can borrow at the lowest premium while others will have to pay higher.

Naveen Kukreja, Co-Founder and CEO at Paisabazaar said that existing floating rate borrowers having adequate surpluses should opt for prepayment to reduce their overall interest cost. They should preferably opt for the tenure reduction option to generate higher savings in interest cost.

"Existing borrowers who have witnessed significant improvements in their credit profile can exercise balance transfer to reduce their interest cost. Their improved credit profile may make them eligible to transfer their existing loans to other lenders at much lower interest rates," he said.

Home buying demand

Vimal Nadar, Head of Research at Colliers India, believes RBI's decision is a significant breather for lenders, developers and homebuyers. "First-time homebuyers will be better placed to make their home buying decision in a stable lending rate regime. Fence sitters in the affordable and mid-segment will have greater visibility of their EMIs and thus affect buying," he said.

Amit Goyal, Managing Director of India Sotheby's International Realty, thinks the pause in rate hikes would instil a sense of optimism among borrowers and the momentum in home sales will continue.

Echoing similar views, Pradeep Aggarwal, Founder & Chairman, Signature Global (India) Ltd, said home loan borrowers have embraced the previous interest rate hikes, and as long as the home loan interest rates hover around 9 percent per annum, it is unlikely to have a significant impact on housing demand.

Piyush Bothra, Co-founder and CFO, of Square Yards, is firm that homebuyers know that their EMIs down the line will only decrease further. "A lot of fence sitters are expected to jump in, and the developers are likely to cash in on this pent-up demand. We firmly believe that we are at the beginning of a multi-year real estate bull market buoyed by high disposable incomes, high affordability and moderate-to-low interest rates," he said.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM