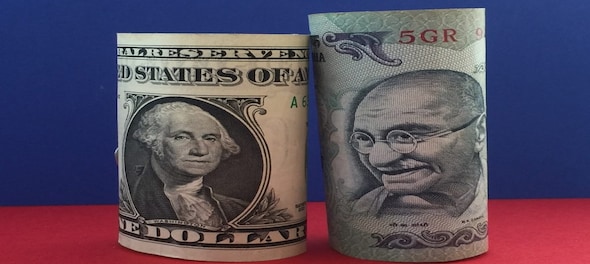

The Reserve Bank of India (RBI) recently relaxed the norms governing non-resident external (NRE) deposits to arrest the outflows from these accounts and bring more inflows. Following the RBI’s change in norms, interest rates on NRE deposits are expected to rise. At present, the State Bank of India offers interest of 5.30 percent on an NRE deposit in the one year to two-year period. In the financial year 2022, the total NRI deposits had declined to $139.02 billion from $141.89 billion in the previous year. NRE deposits account for a major chunk of the total NRI deposits.

Live TV

Loading...

What is an NRE account and who can open it?

An NRE account is a rupee dominated account that can be opened by a person of Indian origin or a person who has become a non-resident Indian (NRI) under FEMA (Foreign Exchange Management Act) guideline. The account facilitates deposit of foreign currency earnings. As the NRE account has high liquidity and allows for full repatriation of funds, it is highly advantageous for an NRI to send money from their country of residence when required.

An NRE account cannot be opened by a power of attorney holder and has to be personally opened by the NRI. An individual can have more than one NRE accounts in India. Such account can be jointly opened with another NRI but not with any other resident. However, the RBI does not allow a person of Pakistani or Bangladeshi citizenship to open an NRE account in India.

Difference with NRO account

As per the FEMA guidelines, the RBI allows NRIs to remit money through two types of savings bank accounts which can be opened with authorised dealers and banks. These are -- non-resident external (NRE) rupee account and non-resident ordinary rupee (NRO) account. NRI can open an NRE account to park their foreign earnings, while the NRO account is opened to manage the income earned by the individual in India. Such income can include rent, dividend, pension and interest.

Types of accounts

An NRI can hold an NRE account as a saving bank, current account, fixed deposits, or recurring deposit. Transfer of money between various NRE accounts can be done freely without any limit. Once the NRI settles back in India, he/she will have to inform the bank, which will then designate the existing NRE accounts as resident accounts and follow banking and taxation provisions accordingly.

Debit and credit

The NRE account is treated as a bank account maintained in a foreign country. Hence, any amount parked in such as account can freely be remitted outside India without any restrictions. However, the RBI allows only limited credits in such accounts. Money remitted from outside India in those currencies permitted by the RBI can be freely credited in the NRE account. Similarly, money realised through cheques, draft or traveller cheques issued outside India in foreign currency can also be freely credited to the NRE account.

An NRI can also credit the income or sale proceeds of investments made in India, which were made on repatriation basis.

Debits can be made from the NRE account to make investments in India either on repatriation basis or on non-repatriation basis. Money from this account can also be used to make local payments such as EMI of home loans in India.

Taxation of interest

Under Section 10(4)(ii) of the Income Tax Act, any interest credited to the NRE account is fully exempt without any limit. As a result, the bank will not deduct any tax on such interest at source. However, once the NRI settles in India and becomes a resident under FEMA rules, the interest on the NRE account will become fully taxable.

(Edited by : Sudarsanan Mani)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

In Ayodhya, voters talk of a promise fulfilled and yearning for development

May 17, 2024 2:10 PM

Fight of heavyweights in Sambalpur where farmers, weavers hold the key

May 17, 2024 12:25 PM

Odisha: Fight of heavyweights in Sambalpur where farmers, weavers hold the key

May 17, 2024 10:22 AM

Lok Sabha Election 2024: What rural Delhi wants

May 16, 2024 10:10 PM