ICICI Prudential Mutual Fund has recently announced the launch of ICICI Prudential Nifty50 Equal Weight Index Fund. The new fund offer (NFO) invests in the constituents of the Nifty50 Equal Weight Index and will close for subscription on September 28, 2022.

Live TV

Loading...

About the fund

The scheme will invest in the constituents of the Nifty50 Equal Weight Index, which consists of the top 50 stocks in India based on market capitalization.

About the index

Nifty 50 Equal Weight Index has grown at 14.15 percent annually since the beginning of 2005. This means Rs 10,000 Invested in Nifty50 Equal Weight Index in 2005 would be worth Rs 1,03,683 by the end of August 2022, according to the AMC

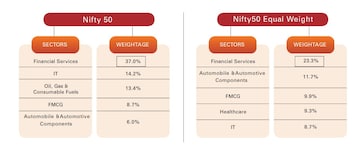

This index would be less concentrated than the Nifty 50 benchmark index in terms of top 5 sector allocations. For example, in the Nifty 50 Index, HDFC Bank’s weightage is 8.37 percent. However, in Nifty50 Equal Weight Index, it is weighted at 1.92 percent.

This means that as against the Nifty 50 index, the Nifty 50 Equal Weight Index is more diversified.

(Source: ICICI Prudential)

Nifty 50 Equal Weight Index has grown at 14.15 percent annually since the beginning of 2005. This means Rs 10,000 Invested in Nifty50 Equal Weight Index in 2005 would be worth Rs 1,03,683 by the end of August 2022, according to the AMC.

(Source: ICICI Prudential)

Nifty50 equal weight Index has outperformed the Nifty 50 Index in 5 out of the last 10 calendar years, according to the AMC.

Who should invest?

The Nifty50 concentrates on financial services -- IT, oil, gas and consumable fuels, FMCG, automobile and automotive components. Another differentiating factor is that an equal weight index has an empirically higher dividend yield than the Nifty 50 index as it allocates funds equally to its components.

"So, this index fund is suitable for those investors who would like to invest in large cap-oriented funds/index," said Rajiv Bajaj, Chairman & MD, Bajaj Capital Ltd, while talking to CNBC-TV18.com.

Chintan Haria, head of product development and strategy at ICICI Prudential AMC, also believes that it offers an excellent diversification opportunity. Also, there is no size bias as the index tries to reduce the impact of bigger companies on the index performance.

"Additionally, the equal weight index has an empirically higher dividend yield than a market capitalisation. The scheme exhibits smart-beta characteristics as the index intends to have no size bias. It will allow non-demat account holders to seek exposure to an equal-weighted index fund. The index is less concentrated and helps provide stability to the portfolio," Haria said.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi Congress chief Arvinder Singh Lovely resigns

Apr 28, 2024 10:54 AM

Lok Sabha polls: Voter turnout in Rajasthan over 62%, down by 4% since 2019

Apr 28, 2024 8:49 AM