ICICI Prudential Mutual Fund has announced the launch of ICICI Prudential Nifty PSU Bank ETF, an open-ended exchange traded fund tracking Nifty PSU Bank Index. The ETF will reflect the performance of 12 PSU bank companies which form a part of the index. This new fund offer (NFO) will be available for subscription till March 15, 2023.

Live TV

Loading...

Speaking on the launch of the product, Chintan Haria, Head – Investment Strategy, ICICI Prudential AMC said, “Over the past decade, PSU banks have undergone a transformation on account of their improving efficiency, customer centric approach, technological superiority and improving risk management frameworks. As a result, since 2018, net NPAs have fallen by over 65 percent while capital adequacy ratio has risen by almost 15 percent. This improvement is reflected in equity market as well, with the Nifty PSU Bank TRI delivering better returns than both Nifty 50 TRI and Nifty Bank TRI over the last few years.”

"In 2022, while there were broad-based gains in the banking pack, it was public sector banks that lead the rally. Investors may consider investing periodically as it enables to accumulate more units during times of market correction. This helps enhance returns when markets head higher due to lower average unit purchase cost," he said.

Why to invest in the ICICI Prudential Nifty PSU Bank ETF?

ICICI Prudential Mutual Fund, in a statement, listed these reasons:

Fundamentals of PSU Bank Index

Nifty PSU Banks are relatively undervalued as against their private peers indicating an opportunity for investors to invest in the good dividend yielding ETF.

Data as on January 31, 2023. Source: www.niftyindices.com

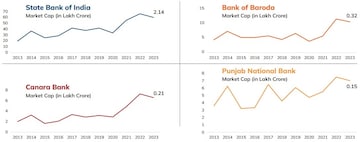

Growth of PSU Banks

Quantum jump in market capitalization of PSU banks in the last 10 years

Top 10 Index Constituents

(Data as on February 28, 2023. Source: www.niftyindices.com.)

(Edited by : Anshul)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Interview | PM Modi targets Naveen Patnaik and BJD — asks Odisha a chance for BJP

Apr 28, 2024 7:53 PM

PM Modi says great men like Nehru and Ambedkar were against reservation based on religion

Apr 28, 2024 6:41 PM

Exclusive | Congress has turned Bengaluru from 'tech hub to tanker hub': PM Modi

Apr 28, 2024 6:18 PM

Modi Interview | Here's what the Prime Minister said on inheritance tax

Apr 28, 2024 6:05 PM