WhiteOak Capital Mutual Fund on Wednesday announced the launch of their new fund offer (NFO) - ‘WhiteOak Capital Large Cap Fund’. The NFO will be open from November 10 to November 24, 2022.

Live TV

Loading...

The fund managers for this fund will be Ramesh Mantri for Equity, Piyush Baranwal for Debt, Trupti Agrawal for overseas investments and Equity and Shariq Merchant for overseas investments.

About the fund

It is an open-ended equity scheme investing predominantly in large-cap stocks. Almost 80 percent of the allocation will be towards large-caps and the fund will be benchmarked against BSE100 TRI.

About large cap funds

These funds invest at least 80 percent of their investible corpus in stocks belonging to large-cap companies. These companies are the top-100 companies in the market.

Large-cap companies are usually fundamentally strong and their stocks are considered low-risk while generating steady returns.

Large-caps are typically market or industry leaders, have diversified revenue streams and in general have stronger balance sheet and greater access to lower cost of capital vis-à-vis their mid cap and small cap peers. These characteristics have led to more stable operational performance during economic downturns which in turn is reflected in a better downside capture ratio. Historically large cap index has performed relatively better in falling markets, according to WhiteOak Capital.

Investment strategy

Investors may choose large cap segment to start their medium to long term SIP. Volatility reduces as investors increase their investment horizon, WhiteOak Capital said in a statement.

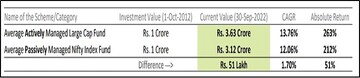

Given below is the table with an average large cap fund vs average Nifty index fund investment journey over the last 10 years:

(Source:WhiteOak Capital)

Ramesh Mantri, CIO, WhiteOak Capital Mutual Fund said, “There are ample active opportunities for alpha generation in the large-cap space through correct sizing and rigorous bottom up stock selection process”.

As per Clear, large cap are an avenue for those who want to take advantage of equity investments but do not want their returns to fluctuate more than the benchmark (i.e. Sensex or NIFTY).

As they are financially stable, they are capable of withstanding bear markets, though there’s a risk that the large-cap might underperform as compared to mid-cap or small-cap equity fund. By saying this, these funds are ideal for risk-averse investors who want equity exposure to high-quality stocks and have a long-term investment perspective.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election Phase 2: Experts decode the key trends and issues in key battleground states

Apr 26, 2024 11:53 PM

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM