April 1 marks the beginning of a new financial year and it is always significant from a personal finance point of view as most of the Budget proposals on income tax take into effect from this day. Additionally, other changes also become applicable from this day which may impact one's money. It's important to take a look at these to avoid any problems while dealing with them.

Live TV

Loading...

Here are key income tax changes that will be effective from April 1:

New tax slabs under new tax regime

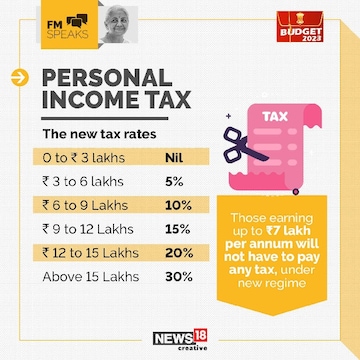

Budget 2023 introduced several changes to the 'new income tax slab', which will be effective from April 1, 2023. As part of this, the tax rebate has been extended on income up to Rs 7 lakh as per Section 87A, as against Rs 5 lakh. The basic exemption limit has been raised to Rs 3 lakh from Rs 2.5 lakh.

As per the revision, an individual with an annual income up to Rs 3 lakh will not have to pay any tax (as against an earlier limit of Rs 2.5 lakh). Further, it has put 5 percent tax for income between Rs 3 – 6 lakh, 10 percent for income between Rs 6-9 lakh, 15 percent for income between Rs 9-12 lakh, 20 percent for income between Rs 12 – 15 lakh and 30 percent above Rs 15 lakh.

The new slab, with changes, will also become default option.

Standard deduction in new tax regime

Standard deduction for salaried employees will be a part of 'new tax slab' from April 1, 2023. Additionally, each salaried person with an income of Rs 15.5 lakh or more will stand to benefit by Rs 52,500 as standard deduction.

Reduced surcharge under new tax regime

The surcharge will be lowered from 37 percent to 25 percent for those earning more than Rs 5 crore a year under the 'new income tax regime'. This means that, with effect from April 1, 2023, all income above Rs 2 crore would be subject to 25 percent surcharge. This also brings down the highest tax rate from 42.74 percent to 39 percent.

TDS on online gaming

The tax deducted at source (TDS) on online gaming applications will be effective from April 1, 2023. TDS on winnings from online games will be deducted for every rupee earned, net of entry fees (if any).

No LTCG and indexation benefits on debt funds

The investment in mutual fund where not more than 35 percent is invested in equity shares of Indian company (which is debt funds) will be considered as short-term capital gains. This means long-term capital gains will go away.

Also, debt funds held for more than three years will no longer enjoy indexation benefits. Additionally, they won't be eligible for a 20 percent tax rate.

Insurance taxation changes from April 1

If premium paid by an individual for a savings life policy is more than Rs 5 lakh than on maturity the income from policy will be taxed. The threshold of Rs 5 lakh will be applicable on first year premium and not first year + renewal.

This will, however, not impact taxation of unit-linked insurance plans (ULIPs), term insurance and old policies, The income from insurance policies with aggregate premium up to Rs 5 lakh shall be exempt. This will not affect the tax exemption provided to the amount received on the death of person insured.

Reduced TDS on EPF withdrawals for non-PAN cases

In case of withdrawals, where EPF account is not seeded with account holders' PAN card, TDS rate will come down to 20 percent from April 1, 2023 or from the beginning of FY24.

Tax exemption up to Rs 25 lakh on leave encashment

The limit of tax exemption on leave encashment on retirement of non-government salaried employees will be raised to Rs 25 lakh from April 1, 2023.

No capital gains on converting physical gold to digital gold

Converting physical gold to Electronic Gold Receipt and vice versa will not be considered a transfer and not attract any capital gains from April 1, 2023. This would promote investments in the electronic equivalent of gold.

New cap on reinvestment of capital gains from the sale of housing property

From April 1, the government will impose a Rs 10 crore cap on the reinvestment of capital gains from the sale of housing property under the provisions of Sections 54 and 54F of the income tax act.

Section 54 lets a taxpayer claim benefits on selling a residential house and acquiring another from the sale proceeds. On the other hand, Section 54F offers tax on the long-term capital gains from the sale of any capital asset other than a house property.

First Published: Mar 31, 2023 3:47 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Loud echoes of Maratha reservation issue in Maharashtra

Apr 28, 2024 3:44 PM

Delhi Congress chief Arvinder Singh Lovely resigns

Apr 28, 2024 10:54 AM

Lok Sabha polls: Voter turnout in Rajasthan over 62%, down by 4% since 2019

Apr 28, 2024 8:49 AM