Equity mutual fund inflows surged to ₹19,932 crore in October 2023 versus ₹13,857 crore in September, as reported by the Association of Mutual Funds in India (AMFI). What's even more noteworthy is that all three major categories, including mid-cap, small-cap, and large-cap funds, attracted significant investments, with each of them showing positive inflows.

Live TV

Loading...

Small-cap funds registered an influx of ₹4,495 crore in October, compared to ₹2,678 crore in September, underlining the growing interest in smaller companies and their potential for growth. The category's Average Assets Under Management (AAUM) also crossed the significant milestone of ₹2 lakh crore for the first time in its history.

The most significant shift was witnessed in the large-cap category, which witnessed a turnaround. After six months of outflows, large-cap funds saw inflows of ₹724 crore in October, indicating renewed investor faith in established companies. Mid-cap funds also saw a substantial increase in investments, with inflows totaling ₹2,409 crore in October, as opposed to ₹2,001 crore in the previous month.

The most significant shift was witnessed in the large-cap category, which witnessed a turnaround. After six months of outflows, large-cap funds saw inflows of ₹724 crore in October, indicating renewed investor faith in established companies. Mid-cap funds also saw a substantial increase in investments, with inflows totaling ₹2,409 crore in October, as opposed to ₹2,001 crore in the previous month.Equity-Linked Savings Schemes (ELSS) attracted ₹266 crore inflows, a notable improvement from the ₹141 crore outflows in September. Dividend yield funds also experienced a boost, with inflows amounting to ₹397 crore in October, compared to ₹255 crore in September.

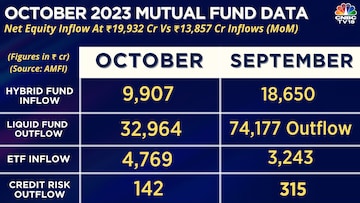

Hybrid funds received investments worth ₹9,907 crore in October. Liquid funds, while still witnessing outflows, saw a significant reduction in the amount, with ₹32,964 crore in outflows in October, compared to ₹74,177 crore in September.

Exchange-Traded Funds (ETFs) attracted ₹4,769 crore in October, surpassing the ₹3,243 crore inflows in September. Conversely, credit risk funds saw an outflow of ₹142 crore in October, a notable change from the ₹315 crore inflow in September.

Debt schemes experienced a positive shift with inflows of ₹42,634 crore in October, compared to outflows of the same amount in September. Meanwhile, corporate bond funds saw an influx of ₹1,940 crore in October, contrasting with the outflows of the same amount in September.

A total of 14 New Fund Offerings (NFOs) were launched in the month, garnering ₹3,638 crore, with ₹2,996 crore flowing into only 4 equity schemes from the multi-cap, small-cap and thematic fund categories.

The total Assets Under Management (AUM) in the mutual fund industry reached ₹46.71 lakh crore in October, compared to ₹46.58 lakh crore the previous month, reflecting overall stability in AUM.

According to Akhil Chaturvedi, Chief Business Officer, Motilal Oswal Asset Management Company, in the month of October, the equity markets continued to experience a risk-off sentiment, with the Index falling below 19,000 levels.

"Despite this fall, equity mutual funds continued to exhibit resilience. This trend reflects the prevalent risk-off sentiment in the market, with investors seeking to diversify their investments while maintaining a focus on capital protection. Domestic flows continue to prove structural," he said.

Commenting on the numbers, Gopal Kavalireddi, Vice President of Research at FYERS said, "The month of October saw an FII selling of ₹29,057 crore, which was aptly countered by the DII purchase of ₹25,106 crore of equities. This was well supported by the retail money through Systematic Investment Plans (SIPs), which rose to a record high of ₹16,928 crore. The total SIP inflows since January 2023 stands at ₹1.49 lakh crore, at an average of ₹14,905 crore on a monthly basis."

(Edited by : Amrita)

First Published: Nov 9, 2023 2:00 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM