The equity mutual funds have witnessed net inflow at Rs 7,505 crore in July 2023 as against inflow of Rs 8,245 crore in June 2023, according to Association of Mutual Funds in India (AMFI) data. Though the net inflows in July were lower than the net inflow of June, it’s substantial in absolute terms, experts said. The net inflow was driven by 5 new NFOs, which cumulatively collected net assets worth Rs 3,011 crore.

Live TV

Loading...

Around 17 open-ended NFOs were floated in July which together mobilized Rs 6,723 crore.

According to Himanshu Srivastava, Associate Director - Manager Research at Morningstar India, the drop in net inflow in July from June could be attributed to some investors booking profit with markets trading near all time highs.

"Some investors would have also chosen to stay on the sidelines and wait for some rationalization to set in before they invest," he said.

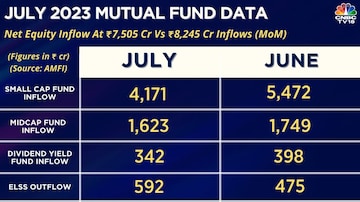

The small cap funds noticed a decrease in inflows. It recorded Rs 4,171 crore inflow in July versus Rs 5,472 crore in June. However, it received the highest inflows among all equity categories. The midcap fund inflow was recorded at Rs 1,623 crore. The dividend yield fund inflow came in at Rs 342 crore. On the other hand, ELSS witnessed outflow of Rs 592 crore.

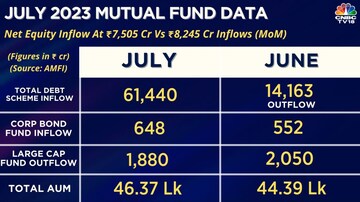

Large cap funds saw the highest outflow of Rs 1,880 crore. This category has been witnessing outflows since the last three months. As per Srivastava, large cap segment has delivered good performance in the recent times providing investors a good profit booking opportunity.

"Investors would have also chosen to prefer currently performing mid and small cap funds over large cap funds," he said.

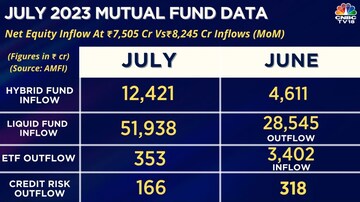

The total debt scheme, meanwhile, posted inflow at Rs 61,440 crore versus Rs 14,136 crore outflows (MoM). The hybrid fund witnessed inflow at Rs 12,421 crore. Liquid funds also noticed inflow at Rs 51,938 crore in July versus Rs 28,545 outflow in June. The credit risk outflow came in at Rs 166 crore.

The corporate bond fund inflow was recorded at Rs 1,880 crore versus Rs 2,050 crore. The ETF outflow stood at Rs 353 crore versus Rs 3,402 crore inflows month-on-month. Focused funds category witnessed an outflow of Rs 1,066.72 crore. The category has been witnessing outflows for the last four consecutive months.

Arbitrage funds received inflow of Rs 10,074.87 crore, against an inflow of Rs 3,365.76 crore in June. The multi asset allocation funds received an inflow of Rs 1,381.50 crore.

The total assets under management stood at Rs 46.37 lakh crore versus Rs 44.39 lakh crore (MoM), the data showed.

Systematic Investment Plan (SIP) inflows, meanwhile, reached a new record high in July. SIP inflows stood at Rs 15,242.7 crore during the month under review. The AUM under mutual fund SIPs was Rs 8.32 lakh crore in July, against Rs 7.93 lakh crore in the previous month.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Rapido offers free rides to voters to polling stations on May 13 in Hyderabad, 3 other cities

May 6, 2024 5:49 PM

Lok Sabha elections 2024: Seats to date, all you need to know about third phase of voting

May 6, 2024 4:49 PM

Concerns on low voter turnout a "myth"; absolute number of voters correct way to analyse: Report

May 6, 2024 2:57 PM

Haryana Lok Sabha elections 2024: A look at JJP candidates

May 6, 2024 2:26 PM