When it comes to investing one’s hard-earned money, everyone is confused. The investors are not sure which instrument will give them the best returns on their investment. Often people who have investible money in their hands do not have much knowledge about the available financial products available in the markets and their advantages and disadvantages, leading to end up making bad investments.

Live TV

Loading...

Experts say that the investors should invest according to their financial goals, risk-taking abilities and other factors that vary from person to person. As everyone wants to make the best out of their investments, mutual fund (MF) schemes have become a favourite avenue to park money for investors. However, common investors in India have little idea about another financial product — exchange-traded fund or ETF — which is very similar to mutual funds and popular among the investors in the US and other Western countries.

Also read:

Ace investor Warren Buffett preferred ETFs to MFs as these funds have lower expense ratio. According to him, indices always go up in the future. ETFs are the funds which track indices such as Nifty50, and Nifty50 Next, among others, and these are not actively managed by fund managers. The performance of these funds depends upon the movements of indices that particular funds track. The investors of an ETF gain when the tracking index goes up.

In India, ETFs have not yet gained popularity among the investors for various reasons. However, investors are now increasingly investing in these funds.

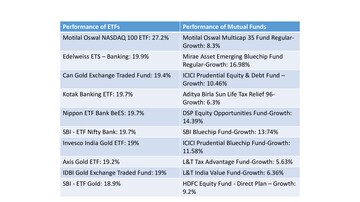

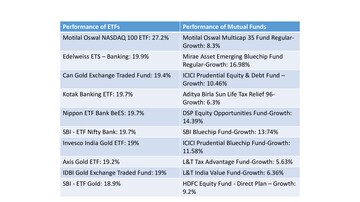

Some of the funds are giving good returns. Motilal Oswal NASDAQ 100 ETF has given 27.2 percent return in a year until December 2019 while Edelweiss ETS - Banking has turned in a 19.9 percent return. Kotak Banking ETF, Can Gold Exchange Traded Fund, Nippon ETF Bank BeES, SBI - ETF Nifty Bank, Axis Gold ETF and Invesco India Gold ETF have given over 19 percent returns, according to data compiled by market advisory marketplace Advisorymandi.com.

These funds have certainly beaten most of the mutual funds in earnings. Mirae Asset Emerging Bluechip Fund Regular-Growth, one of the best performing mutual funds, has given 16.98 percent return to the investors. The returns of DSP Equity Opportunities Fund-Growth, another good performing mutual fund, has been at 14.39 percent.

Mumbai-based tax and investment expert Balwant Jain, however, is not on the same page with Warren Buffett on ETF investment. Jain said the investors should invest in mutual funds to maximise their returns on investment, as ETFs are not actively managed by the fund managers.

“The investors should go for mutual funds according to their risk- appetite rather than investing in ETFs. They should not put their money in ETFs because the expense ratio of these funds is low. The investors who want to take a lower degree of stress may go for large-cap funds and the investors with higher risk-taking ability may opt for small-cap or mid-cap funds. There are also Gold-ETFs but that are also not that attractive,” Jain added. He concluded that mutual funds are the best option for the common investors, as fund managers actively monitor them.

Sebi registered investment Amit Kukreja is in the opinion that the investors should take mix exposure of mutual funds and ETFs. “One should invest a part of their portfolio in ETFs, as part of their investment plan. Unfortunately, ETFs have not yet gained popularity among the investors in India may be because of liquidity issue. However, the liquidity of these funds is improving gradually. ETF is the future and it will do well in some years down the line,” Kukreja said.

ETFs have certain advantages such as low expense ratio compared to mutual funds and give good returns when indices go up over years, said Kukreja. However, investors should track the performance of their funds’ performance closely.

“ETFs incur lower cost compared to mutual funds as there is no fund manager fees and limited churn. However, there are brokerage charges and can have higher trading costs due to this. As one needs a Demat account to invest in ETFs and can be a good option to start for investors if they want to start with index funds,” said Shweta Jain, independent CFP.

“But in India, mutual funds can still generate better returns than ETFs and hence one should have a combination of both,” She said, "The combination can be as per one’s risk appetite and time horizon.”

First Published: Dec 12, 2019 2:38 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM