Gang initiated the discussion by highlighting pivotal changes brought about by the Securities and Exchange Board of India (SEBI) in 2018.

SEBI's geographical classification based on factors like financial development, infrastructure, and overall progress differentiated between the top 30 metro cities and the subsequent 30 cities, is termed as B-30. This classification is aimed to glean insights into the origins of mutual fund assets.

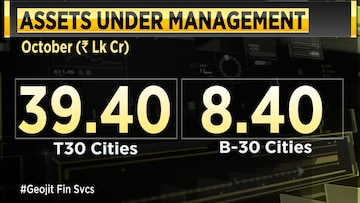

According to Gang, the data from October indicates that approximately ₹39.4 lakh crore stems from the top 30 cities, while the next 30 cities contribute around ₹8.50 lakh crore to the mutual fund AUM.

Beyond these, the next tier of cities adds an additional ₹2-3 lakh crore. Notably, the B-30 cities have witnessed significant progress over the past decade.

Reflecting on the growth of B-30 cities, Gang remarked, "If we rewind 10 years and look at the percentage share of B-30 towns and cities in 2012, it was around 6 or 7%. Today, it has surged to approximately 25-26%, if not more."

This leap underscores the progress these cities have made in contributing to the mutual fund landscape.

While the top 30 cities continue to dominate the mutual fund market, Gang emphasised the growth and development witnessed in the B-30 cities.

He acknowledged their increasing contribution to the overall AUM, highlighting the trajectory of progress observed over the past decade.

For full interview, watch accompanying video