In September, multi-asset mutual funds experienced a significant surge in inflows, reaching Rs 6,324 crore, a substantial increase from the Rs 1,617 crore recorded in August 2023. Salonee Sanghvi, the Founder of My Wealth Guide, attributes much of this category's newfound popularity to the recently implemented tax structure, which took effect on April 1.

The revised

tax structure has removed the indexation benefit for funds with less than 35% allocation to equities. Given that

multi-asset funds allocate 65% of their investments directly into equity or through hedge funds and the remainder into a combination of debt and

gold, they are in a more favorable position compared to pure debt funds.

Sanghvi, in an interview with CNBC-TV18, stated that multi-asset

mutual funds are particularly well-suited for passive investors seeking diversification and tax-efficient investment options. She emphasised that a time horizon of 3 to 5 years is ideal for those considering investments in this category.

"Multi-asset funds can be a great option for people looking for diversification since it invests in different asset classes and reduces risks. Another category could be passive investors who prefer a hands-off approach and want a professional manager to take the rebalancing call between different asset classes along with the tax efficiency that it offers," Sanghvi said.

Nevertheless, Sanghvi cautioned that multi-asset funds come with higher costs due to their elevated expense ratios. Additionally, they do not offer customisation or control over asset allocation, as the fund manager makes allocation decisions based on prevailing market conditions.

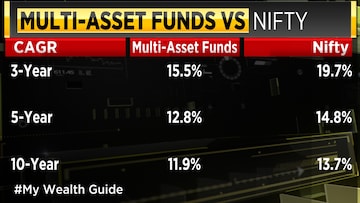

Sanghvi also pointed out that, over a longer duration, multi-asset funds typically tend to underperform the equity markets, primarily due to asset diversification. On average, over a three-year period, multi-asset funds have delivered a Compounded Annual Growth Rate (CAGR) of 15.5%, compared to the Nifty's 19.7% returns, she noted.

Watch accompanying video for entire discussion.