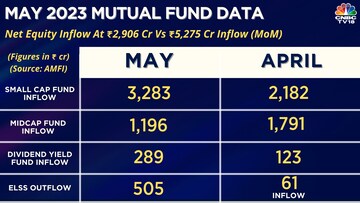

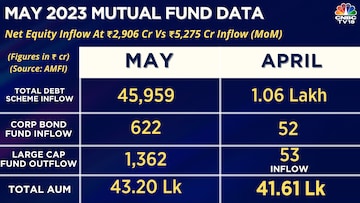

The May 2023 mutual fund industry data released by Association of Mutual Funds in India (AMFI) highlighted some key insights. While the equity mutual funds witnessed a net inflow at Rs 2,906 crore in May 2023, the total debt scheme saw an inflow at Rs 45,959 crore. Here are key trends that AMFI data showed:

Live TV

Loading...

Inflows into equity funds lowest since November, but positive for 27th month

Equity mutual funds have witnessed a net inflow of Rs 2,906 crore in May 2023 as against Rs 5,275 crore in April 2023. This was the lowest recorded inflow since November 2022 when Rs 2,224 crore came in. While this was the 27th consecutive month that the asset class garnered net positive flows, when compared to the last couple of months, the quantum of flows has reduced significantly.

Within equities, the highest outflows were seen in the large cap category followed by the focused category and ELSS category.

"Profit booking coupled with concerns regarding the US government’s decision to raise the debt ceiling could have led to investors withdrawing money from these categories during the month," said Melvyn Santarita, Analyst - Manager Research at Morningstar India.

Small cap funds' inflows at record high

Among the categories which saw the highest net inflows were the small cap category followed by the midcap category and large and midcap category. Interestingly, the flows seen in the small cap category has been the highest till date.

Both the mid cap index as well as the small cap index witnessed a tepid performance in 2022 on the back of strong performances in 2020 and 2021. Interestingly, investors on the other hand, have shown to be quite persistent when it comes to investing in both these categories. The last time these categories witnessed net outflows was in Feb 2021 for midcap and Sept 2021 for small cap.

Debt funds see sharp decline

Debt oriented schemes witnessed net inflows for the second consecutive month. In May, the segment witnessed a net inflow of Rs 45,959 crore as against the net inflow of Rs 106,677 crore in the previous month. Categories with shorter duration profile were the major contributor towards positive flows for the segment.

Ultra-short duration, low duration and money market funds, on the other hand, witnessed inflows. Credit-risk funds witnessed outflows for the second month at Rs 289 crore in May. These schemes had recorded outflows of Rs 356 crore in April.

SIP contributions hit record high

The Systematic Investment Plan (SIP) saw an inflow of Rs 14,749 crore in May 2023. In April, the same was registered at Rs 13,728 crore compared with Rs 14,276 crore in March, a fresh all-time high then.

Gold ETFs continue to glitter

Gold ETF continue to glitter as it received a net inflow of Rs 103 crore in May. The net inflow was slightly higher in April at Rs 124.54 crore. Gold prices came off its highs towards the second half of May on the back of positive news with regards to the US government raising the debt ceiling thereby providing some buying opportunity, particularly after a sharp rally it witnessed since March this year.

"With gold prices still trading at high levels, some investors would have chosen to book profits or take on risk on approach with a view that central banks would pause further rate hikes. This view seems to be materialising. That said, pertinent risks still engulf developed economies and therefore over the course of the month, investors flocked to gold ETFs which is considered as a safe haven during uncertain times," Santarita said.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM