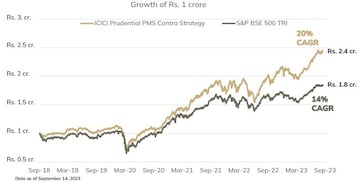

ICICI Prudential PMS Contra Strategy, an offering which involves taking contrarian bets on equity stocks, has completed five years. According to a statement from the fund house, a lump sum investment of Rs 1 crore at the time of inception (September 14, 2018) in the strategy would be approximately Rs 2.4 crore i.e. an annualised return of 20 percent by as of September 14, 2023.

Live TV

Loading...

A similar investment in S&P BSE 50 TRI would have yielded an annualised return of 14 percent at approximately Rs. 1.8 crore, ICICI Prudential said.

The strategy as the name suggests invests in equity stocks which are currently not in favour in the market but are expected to do well in the long run. The portfolio may also have stocks of companies in sectors where entry barriers are high, sectors in consolidation or of companies in special situation.

Speaking on the occasion, Anand Shah, Head - PMS & AIF Investments said, “The performance draws attention to the investment framework which revolves around the core belief that companies create wealth, not markets.”

He further added, “Identifying contrarian opportunities in the market played a pivotal role in the strategies performance, demonstrating the capability of capturing investment prospects and saying ahead of the curve.”

ICICI Prudential PMS relies on an in-house Business-Management-Valuation (BMV) framework that aims to identify resilient companies with a potential for long-term growth. Through this framework, the team identifies strong companies with competent management that are trading at reasonable valuations.

Over the past five years, the Contra Strategy largely focused on manufacturing and related sectors to generate alpha. Manufacturing sectors like metals, industrial products, and auto ancillaries, along with manufacturing-related sectors like logistics, corporate banks, and utilities, were attractive investment opportunities which were available at reasonable valuations and offered strong earnings potential. Another factor which aided in the strong fund performance is going underweight on Information Technology (IT), Consumer Goods and Pharmaceutical sector, ICICI Prudential said.

As on August 31, 2023, the portfolio comprises of 24 companies with the top 10 holding forming 56 percent of the portfolio. In terms of market cap breakup, large caps form 53.2 percent of the portfolio followed by smallcap at 25.6 percent and midcaps at 21.2 percent. Below is the performance as on August 31, 2023:

| 1 Month | 3 Months | 6 Months | 1 Year | 2 Years CAGR | 3 Years CAGR | 4 Years CAGR | Since Inception | |

| Contra Strategy | -0.84% | 12.94% | 24.95% | 24.99% | 17.12% | 31.19% | 24.62% | 19.42% |

| S&P BSE 500 TRI | -0.61% | 7.73% | 17.34% | 11.34% | 9.15% | 23.33% | 18.70% | 13.40% |

(Source: ICICI Prudential)

(Edited by : Anshul)

First Published: Sept 27, 2023 4:21 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi Congress chief Arvinder Singh Lovely resigns

Apr 28, 2024 10:54 AM

Lok Sabha polls: Voter turnout in Rajasthan over 62%, down by 4% since 2019

Apr 28, 2024 8:49 AM