Equity markets have been facing unprecedented volatility of late, making investors anxious. However, the good news is that there are several strategies that can help in generating better risk-adjusted returns during these uncertain times too.

Live TV

Loading...

While diversification and asset allocation are some of the most effective ways to manage risk, two new strategies -– factor and momentum investing--are steadily becoming popular. But what are they and how they work?

Understanding the terms

Factor investing is an investment strategy that focuses on specific characteristics or factors that are believed to drive returns, such as value, momentum, size, and quality. Momentum investing, on the other hand, involves buying stocks that have exhibited strong performance in the recent past and selling stocks that have underperformed.

How factor investing works?

By investing in a portfolio of securities with specific factors, investors aim to capture the excess returns associated with them while reducing exposure to other risks in case of factor investing, Sonam Srivastava, Founder at Wright Research said while talking exclusively to CNBC-TV18.com.

"Factor investing has gained popularity as it is more transparent and explainable compared to traditional methods. It delivers consistent returns and allows investors to diversify their portfolios in a more nuanced way than traditional asset allocation methods," she said.

Attributes that can be considered a factor

Not every attribute of a stock can be considered a factor.

Factors are specific characteristics or attributes of stocks that are believed to drive returns and are backed by empirical evidence. For a characteristic to be considered a factor, Srivastava said that it must be associated with excess returns that cannot be explained by exposure to other factors.

"While there are many attributes that can impact a stock's risk and return, not all of them can be considered factors. For example, a stock's color or name may have no bearing on its performance and cannot be considered a factor. Factors are generally based on fundamental or quantitative characteristics such as valuation ratios, earnings growth, and market capitalization," she explained.

Performance of factor investing strategy over a longer time frame

The performance of factor investing strategies over a longer time frame has varied depending on the specific factors and market conditions. However, on average, factor-based strategies have been found to generate excess returns compared to traditional market-cap weighted index funds.

(Source: Historical performance of Factor Strategies as published by NSE)

"Several academic studies have analyzed the performance of factor investing over longer time frames, and the evidence suggests that certain factors, such as value and momentum, have historically provided investors with a premium for taking on additional risk. In India which has gone through large periods of bull markets, we have seen momentum or trend following to be the most powerful factor. Size or investing in smaller stocks is also a powerful factor in India," Srivastava told CNBC-TV18.com.

(Last one year performance of Nifty Factor Indices)

How momentum investing works?

Momentum investing strategy is based on the idea that stocks that have performed well in the recent past are likely to continue performing well in the future, while stocks that have performed poorly are likely to continue underperforming.

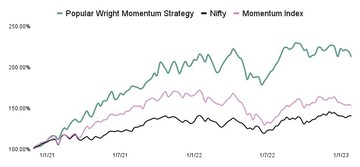

(Comaprison of nifty, momentum and Wright Momentum strategy)

Investors can follow momentum investing by first identifying stocks that have exhibited strong momentum by looking at their recent price movements or earnings growth. They can then invest in a portfolio of these stocks while shorting stocks that have exhibited weak momentum.

How advisable it is?

As per Srivastava, individuals should consider momentum investing strategy while investing as it has been shown to generate excess returns over the long term.

"By investing in stocks with positive momentum, investors can participate in the market's upside potential and potentially avoid stocks that may underperform" Srivastava told CNBC-TV18.com.

Further, momentum investing can help investors capture the trend of a stock and benefit from market momentum. Additionally, it can be a useful tool for diversifying a portfolio as it can provide exposure to stocks that may not be captured by traditional asset allocation methods.

However, Srivastava added that it's important to have a long-term investment horizon, a diversified portfolio, and to work with a qualified investment professional who can help investors in identifying the right momentum stocks and construct a portfolio that meets unique needs and goals.

A look at current index performance- What lies ahead?

Given the current emerging global risk factors such as India's over-valuation, sticky core inflation, high-interest rates and the continuing war in Ukraine, Srivastava said that it is difficult to predict whether the Indian index will make new highs in the near term.

"These factors can continue to weigh on investor sentiment and create uncertainty in the markets. However, the good part is that stock market is forward-looking and tends to anticipate future economic and corporate performance. If there are positive developments in any of the above factors or any other favourable news, the market could rebound and make new highs," she said.

To conclude: investors should focus on building a diversified portfolio, keeping a long-term investment horizon and considering risk-management strategies to manage the impact of the current global risks on their portfolios.

(Edited by : C H Unnikrishnan)

First Published: Mar 3, 2023 2:01 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM