Ahead of International Women’s Day on March 8, IndiaLends conducted its 5th Edition of #WorkingStree, an annual survey of working women across India. The survey covered over 10,000 working women in the 21-65 age group residing in metros and tier 1 and 2 cities across 4439 unique pin codes of India. The survey was conducted online in February 2023, aimed at understanding the pulse of the Indian working women vis-à-vis financial independence and career choices. Here’s a look at some of the key findings.

Live TV

Loading...

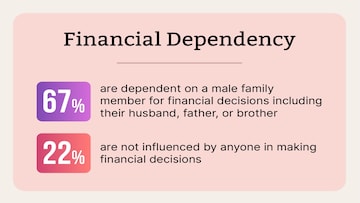

Financial Dependence

According to the survey, nearly 67% of working women were still dependent on male members of the family to make financial decisions. While over 22% of the respondents were not influenced by anyone in making financial decisions.

The survey revealed that almost half of the working women were only making decisions related to discretionary expenses independently and only about 1/4th of women were able to make investment decisions independently. While 1/4th of the respondents said they find investments “complex and confusing”.

Also Read: 20 startup leaders graduate from 'Google for Startups Accelerator-India Women Founders' programme

Income and Contribution

The survey found that over 90% of the respondents were contributing towards household expenses with nearly 40% chipping in with more than 50% of their income. However, nearly 70% of these women earn less than Rs 5 lakh annually, while 23% are in the Rs 5-10 lakh annual income bracket.

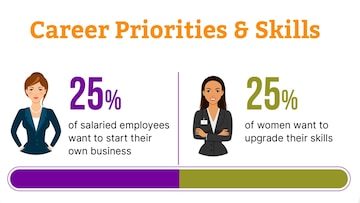

Career Priorities and skills

The survey also uncovered the desire amongst salaried women to turn entrepreneurs. According to the survey, nearly 1/4th of salaried women want to start their own business while another 1/4th want to upgrade their skills as a key career priority.

Learning finances

The survey shows that nearly half of working women were learning about personal finance from social media, about 30% from news articles, and 20% from workshops and seminars, followed by professional experts.

Motivation to work

The survey suggested that for 1/3rd of the women polled, financial independence was the most important work motivation. While 26% said they were working to support their families, about 21.6% said they were working for improving self-confidence. About 6.7% of the respondents said they worked to keep themselves occupied.

IndiaLends Founder and CEO Gaurav Chopra said, “Empowering women to take charge of their finances is not just a moral imperative, but also an economic necessity. It is time for us as a society to break down traditional barriers and create equal opportunities for all. At IndiaLends, we are committed to supporting and empowering working women to take control of their financial lives, and this #WorkingStree report only reinforces our belief in the urgent need to accelerate this change.”

“It is heartening to see that women today are active contributors in the household and that they have started taking an interest in knowing more about personal finance,” Chopra added.

First Published: Mar 7, 2023 8:44 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM