Home

Terms and Conditions

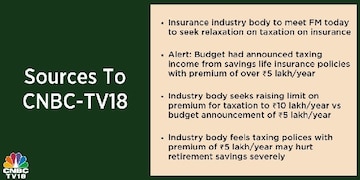

homepersonal finance NewsExclusive | Insurance industry body seeks raising limit on premium for taxation to Rs 10 lakh — may meet FM today

Exclusive | Insurance industry body seeks raising limit on premium for taxation to Rs 10 lakh — may meet FM today

Budget 2023 proposed to take away the tax free advantage from savings insurance plans issued on or after April 1, 2023 whose annual premium is above Rs 5 lakh.

Insurance Regulatory and Development Authority (IRDAI) is likely to meet Union Finance Minister Nirmala Sitharaman on Tuesday to seek relaxation on taxation on insurance policy, sources informed CNBC-TV18. The insurance industry body is expected to ask Sitharaman to raise premium limit for taxation to Rs 10 lakh per year versus budget 2023 announcement of Rs 5 lakh per year, sources said.

The industry body feels that taxing policies with premiums of Rs 5 lakh per year may hurt retirement savings severely.

What was the Budget 2023 announcement?

Budget 2023 proposed to take away the tax free advantage from savings insurance plans issued on or after April 1, 2023 whose annual premium is above Rs 5 lakh. The new proposal will, however, not impact taxation of unit-linked insurance plans (ULIPs), term insurance and old policies.

Simply put, if premium paid by an individual for a savings life policy is more than Rs 5 lakh than on maturity the income from policy will be taxed. The threshold of Rs 5 lakh will be applicable on first year premium and not first year + renewal.

Several industry experts said that the proposal will have a detrimental impact on the insurance business.

Prashant Tripathy, the MD and CEO of Max Life Insurance, stated that the announcement was a disappointment from an industry perspective. According to him, policies with a premium of more than Rs 5 lakh account for only 8-9 percent of the total portfolio. Despite this, he believes that the impact of the new Value of New Business (VNB) guidelines will be lower than the 8-9 percent figure.

In an interaction with CNBC-TV18, Vibha Padalkar, MD & CEO, HDFC Life Insurance said that the budget changes linked to insurance is likely to have a 10-12 percent impact on the top line. The impact on the bottom line is likely to be around 5 percent if we do nothing to mitigate the impact of change, she said.

Other experts say that the biggest impact will be on HDFC Life Insurance as the firm has 35-40 of its portfolio of savings products. HDFC Life, compared to other players has larger share of larger ticket policies.

First Published: Feb 7, 2023 11:42 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Rapido offers free rides to voters to polling stations on May 13 in Hyderabad, 3 other cities

May 6, 2024 5:49 PM

Lok Sabha elections 2024: Seats to date, all you need to know about third phase of voting

May 6, 2024 4:49 PM

Concerns on low voter turnout a "myth"; absolute number of voters correct way to analyse: Report

May 6, 2024 2:57 PM

Haryana Lok Sabha elections 2024: A look at JJP candidates

May 6, 2024 2:26 PM

Most Read

Share Market Live

View AllTop GainersTop Losers

CurrencyCommodities

| Currency | Price | Change | %Change |

|---|