The Union finance ministry on Thursday has indicated that it will not roll back the recent changes made to the Foreign Exchange Management Act (FEMA) that brought international spending using credit cards under the limits existing under Liberalised Remittance Scheme (LRS). These changes not only included any such credit card usage under the $250,000 per year limit allowed by RBI, but also imposed a 20 percent Tax Collected At Source (TCS) on such transactions.

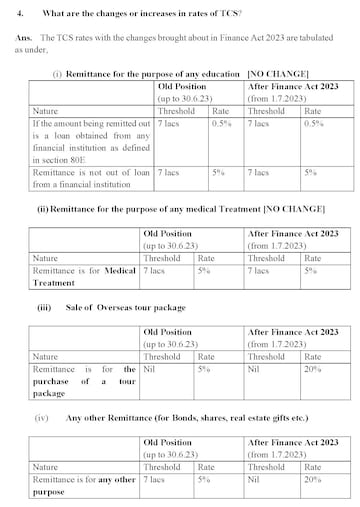

The move had created a lot of confusion among people, and drawn criticism that the increased TCS rate (it was 5 percent earlier) would make foreign travel, especially by employees, students, and people travelling for medical purposes, more difficult.

In a set of Frequently Asked Questions (FAQs), the Union finance ministry has defended the changes to FEMA and said these changes have been a long-pending request by the RBI, owing to several reasons.

One of these is that international transactions using debit cards have always fallen under the LRS limits, while credit cards have not. This was a discrepancy the RBI wanted to remove since it led to some individuals exceeding the $250,000 per annum LRS limits.

Second, the RBI has noticed instances where international credit cards were being issued with limits that exceeded the LRS limit of $250,000. This loophole had to be closed.

The finance ministry has also pointed out that foreign remittances under LRS have doubled to $24 billion in FY23, from three years ago; 50 percent of this remittance is on overseas travel alone.

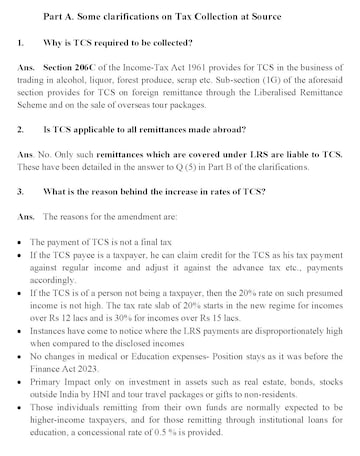

In the same FAQs, the finance ministry has also tried to allay many concerns that were raised when the amendments were first notified. For instance, it has clarified that taxpayers can claim credit for TCS paid for such international transactions against regular income, and adjust it against any advance tax paid, etc.

If the transactions are being made by a non-taxpayer, the finance ministry argues that a 20 percent TCS on such transactions is not a large amount, given the presumed income of such spenders. It argues that the purpose of the 20 percent TCS is to clamp down in instances where LRS payments are disproportionately high when compared to disclosed incomes.

The finance ministry has also clarified that the amendments to FEMA do not change the exemptions already offered for medical or education expenses, explaining that the TCS is aimed at investments in assets like real estate, bonds, and stocks outside India, which are usually done by High Net-worth Individuals (HNIs).

The higher tax rate is also aimed at tour travel packages and gifts to non-residents. It argues that individuals remitting their own funds abroad are usually expected to be higher-income taxpayers in any case.

The concessional rates of 0.5 percent TCS are already applicable on remittances of money through institutional loans for educational purposes, remittances for travel and incidental expenses related to education, and remittances for travel and incidental expenses related to medical purposes remain untouched. The higher TCS rate is also not applicable to employees who travel abroad as representatives of the company they work for, where the company bears the expenses of such travel.

The finance ministry believes that the amendments to FEMA will help capture the total spending under LRS, allowing for prudent foreign exchange management. It will also prevent the bypassing of LRS limits through loopholes that existed. Any expenditure that exceeds the LRS limit of $250,000 per annum will need prior RBI approval.

First Published: May 18, 2023 7:44 PM IST