ICICI Prudential Mutual Fund has announced the launch of ICICI Prudential PSU Equity Fund. This new fund offer (NFO) will open for subscription tomorrow and close on September 6.

Live TV

Loading...

This is an open- ended equity scheme with an objective to provide long-term capital appreciation by investing predominantly in equity and equity related instruments of PSU companies, the fund house said.

The scheme may invest in sectors/stocks that form a part of S&P BSE PSU Index. The scheme may invest in opportunities across market cap i.e. large, mid or small cap, it said.

The fund will be managed by Mittul Kalawadia and Anand Sharma.

Speaking on the launch of the product, Chintan Haria, Head - Product Development and Strategy, ICICI Prudential AMC said, “PSU companies form an important constituent of capital markets and are present across different sectors presenting wide investment opportunities. Also, PSUs appear to be attractively placed on valuation basis and offer better margin of safety. In a volatile environment, companies providing high dividend yield tend to have higher demand resulting in capital appreciation.”

Other factors which make PSU space attractive (according to the fund house) is as follows:

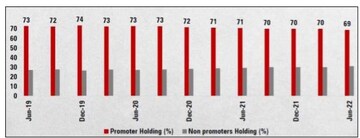

1) Government Ownership

Promoter holding i.e. government ownership in PSU companies is substantial compared to non-promoters (FPIs, DIIs & Retail). As these companies are highly under owned by non-promoters, the PSU space provides

better Margin of Safety.

(Source – Antique Broking. FPI – Foreign Portfolio Investors, DII – Domestic Institutional Investors)

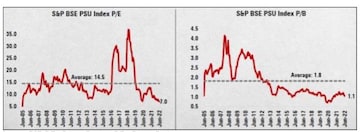

2) Attractive Valuations

Starting point i.e. valuations in PSU space have been attractive for a while now again indicating that companies have better Margin of Safety.

(Source – BSE. P/E – Price to Earnings, P/B – Price to Book)

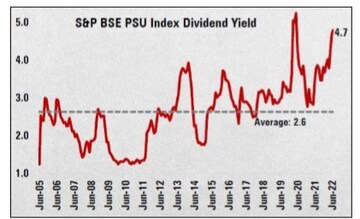

3) High Dividend Yields

• PSUs tend to offer better dividend yield than broader markets

• Average dividend yield of S&P BSE PSU Index (last 17 years) is 2.6 whereas that of S&P BSE Sensex is1.3

• In a volatile environment, companies providing high dividend yield tend to have higher demand resulting in capital appreciation

(Source – BSE)

4) Sectors with PSU dominance which may do well

PSU Banks - Public Sector Banks are in the middle of a cycle change wherein Return on Equity has just begun to pick up and credit cost appears to have bottomed out with better asset quality.

Defence - With government focusing on indigenization by allocating ~ Rs.764 billion for the armed forces to bolster defence capabilities and reduce foreign spend on systems/equipment, defence (with major PSU contribution in overall production) is expected to do well.

Power - Power generation is mainly dominated by PSU players. Power demand has been on a rise despite pandemic impact. This, coupled with fixed ROE for power generating stations, bodes well for the sector.

Historically, in the run up to elections, PSUs tend to perform well on optimism around reforms. PSUs could do well over next 2 years given pre-election period. Apart from these, investing in PSU stocks provides a range of benefits.

Cost of borrowing is low owing to inherent sovereign comfort leading to better credit rating/standing. This is beneficial during rising interest rate scenario. In addition, PSU stocks have relatively less Key Managerial Personnel risk from a continuity perspective as compared to promoter run company.

PSU companies pose lesser risk of diversification into unrelated businesses and they also tend to pay higher dividends.

(Edited by : Anshul)

First Published: Aug 22, 2022 5:56 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM