The topic of this post may seem odd, given what I regularly write about ULIPs. I advocate mutual funds over unit-linked insurance plans (ULIPs) and for good reasons. I do not deny bias though.

Live TV

Loading...

I wrote a detailed post comparing mutual funds and ULIPs and showing why I prefer mutual funds over ULIPs, despite ULIPs enjoying far superior tax treatment as compared to mutual funds.

However, there are investors who see merit in ULIPs and look to invest in a good ULIP. I must say that the insurance companies have been able to come up with product structures that investors can easily relate to (even without understanding those products well). Whatever your reason be to purchase a ULIP, you must still select a good ULIP.

In this post, let’s look at how you can select a good ULIP for yourself.

Type-I ULIP vs Type-II ULIPs

The difference is in the quantum of the death benefit.

Type-I ULIP: In the event of the death of the policyholder, the nominee gets the higher of fund value, sum assured. As you can see, the liability of the insurer goes down as your fund value grows. This is because, in the event of the investor’s demise, the insurer merely needs to pay the difference between the Sum Assured and Fund Value from its pocket.

Mortality charges are calculated based on Sum-at-risk (Sum-at-risk = Sum Assured – Fund Value). As the Fund Value grows, Sum-at-risk goes down and the effect of mortality charges goes down too.

The impact of mortality charges is lower in case of Type-I ULIPs. When the Fund Value gets bigger than the Sum Assured (remains that way), you do not incur any mortality charge. Mortality charges are typically recovered through cancellation of units on a monthly basis.

Type-II ULIP: In the event of the death of the policyholder, the nominee gets Fund Value + Sum Assured. In this structure, the liability of the insurer remains constant at Sum Assured till maturity. Sum-at-risk is always equal to Sum Assured. Thus, the impact of mortality charge is higher (but you also get higher life cover).

Do note, a ULIP (both Type I and Type II) is a very expensive way of purchasing life cover. As discussed in an earlier post, you pay much higher to get the same level of cover in a ULIP (as compared to a term plan).

Which one to choose?

If you are looking at a ULIP purely from an investment perspective (you already have adequate life insurance), a Type-I ULIP is a clear winner over Type-II ULIP. However, you must understand that your Sum Assured will be at least 10 times your annual premium (for tax-exempt maturity proceeds). Therefore, it will take a lot of time for the Fund Value to exceed the Sum Assured. Till such time, mortality charge is an unnecessary cost you must bear.

If you are looking at a ULIP to bridge a serious insurance gap in your portfolio, a Type-II ULIP is likely a better choice. However, I believe a mix of term plan and Type-I ULIP is a better choice than a Type-II ULIP. Moreover, in case of ULIPs, the Sum Assured is a multiple of the annual premium. For instance, in most cases, the Sum Assured is 10 times annual premium. An annual premium of Rs 50,000 per annum will get you a cover of Rs 5 lakh. In such a case, your ability to pay the premium will determine the life insurance you can get. If you are relying only on ULIPs for life cover, you run the risk of staying underinsured.

You must note ULIP maturity proceeds are exempt from income tax only if the Sum Assured is at least 10 times the annual premium. For older investors, this condition may not satisfy. Moreover, the impact of mortality charges is also higher for older investors. Such old investors must avoid ULIPs.

Do not go with ULIPs with Premium Allocation and Policy Admin Charges

These costs only add to the cost and lower your returns. And there is no dearth of ULIP products which do not have such charges.

I did a comparison of two products (one with such charges and one without) in an earlier post. Do refer to the post to understand the impact.

If you purchase your ULIP online, you are likely to avoid such charges.

3. Compare the Mortality Charges

This is one aspect that most of us do not focus about. As I have discussed earlier, mortality charges eat into your returns. This happens because mortality charges are recovered through cancellation of fund units, effectively reducing the number of units you own and your wealth.

To assess the impact, you need to look at the mortality table, which is provided in the sample policy wordings. You can download policy wordings from the insurer website. Alternatively, simply google <policy name> policy wordings. You will most likely land up on the right page.

All you must do is to compare mortality tables with other plans from the same company and from the other company.

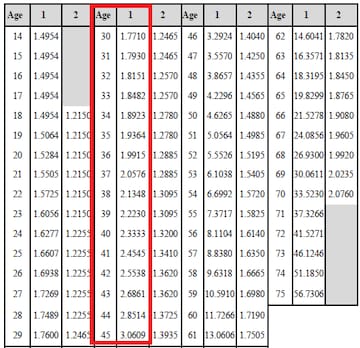

For instance, look at the mortality tables from the plans from two different insurers.

Just look at these tables. Mortality cost is expressed as per Rs 1,000 of Sum-at-risk.

In the first plan, if the Sum-at-risk remains constant at Rs 50 lakh, you will incur mortality cost of Rs 8,855 + 18 percent GST = Rs 10,448 in the first year. 1.771*50 lakh/1,000 = Rs 8,855.

In the second plan, you will incur only Rs 4,000 + 18 percent GST = Rs 4,720.

If you appreciate the power of compounding, you will know the difference these minor values can make.

If I had to make a choice, I would have gone with the second plan.

4 Look at fund management charges

Even though Fund Management Charges for ULIPs are capped at 1.35 percent p.a., 1.35 percent p.a. is still a very high number for debt funds.

Do compare the fund management charges for various kinds of funds. Everything else being same, lower fund management charges will add to your returns.

5. Look at the contingent charges

Contingent charges are applicable if you do a specified activity.

For instance, if you want to discontinue ULIP before 5 years, the insurer may ask you to pay a small discontinuance charge.

Every insurer typically allows you a few free switches across ULIP funds. Beyond that, they may charge a small amount per switch.

Though these charges are unlikely to be a deal breaker, you must still understand the nature and quantum of such contingent charges.

6. Loyalty Additions and Boosters are an additional sweetener

Loyalty Addition is a reward for staying long enough in the policy. The insurance companies provide this benefit in form of an additional amount at maturity or in the form of additional fund units during the regular course of the policy. Though the benefit is not significant, it is a benefit nonetheless. Do note nomenclature can vary.

I have always assumed that such benefits, in some way, must be recovered from the investors, perhaps in the form of higher Fund management charges or mortality charges or any other charge. However, when I looked at a few ULIPs, I did not find much correlation. In fact, a couple of products (not all) which offered these benefits had lower fund management and mortality charges (as compared to those which didn’t). I could not find any additional costs either in those plans. The plans which are not offering such benefits but still have higher costs need to review the cost structure. There is much room for improvement.

Do note these loyalty benefits should not be the focal point. Insurance companies can spin it as a great benefit (which it is unlikely to be). Look at the cost structure (various charges) before falling for it.

However, loyalty addition is an added benefit. Just ensure that you are not short-changed.

7. What about Fund performance?

In this list, I have focussed more on reducing the cost associated with a ULIP.

However, if you are looking at a ULIP as an investment product, you would want to look at the past performance of the funds too.

You can also look at long term performance of the funds. This aspect is not very high on my list because past performance may not repeat. Do remember you will be stuck in the same ULIP even if funds don’t do well. You can’t exit an underperforming ULIP. So, you require a leap of faith while selecting a ULIP.

Look at the long-term performance of funds. Do not just look at the performance of the best performing fund in the ULIP. Look at all the funds offered in the ULIP.

8. Avoid Single Premium ULIPs

In case of single premium ULIPs, it is likely that the maturity amount won’t be exempt from tax, effectively nullifying the single biggest advantage of ULIPs over mutual funds. Not just that, if you are over 45, you may be offered regular premium ULIPs where Sum Assured is less than 10 times annual premium. The maturity amount is taxable in those cases too.

These are the aspects that I would consider if I were to purchase a ULIP.

First Published: May 3, 2019 12:21 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: Radhika Khera, Shekhar Suman join BJP; meet all who are now in saffron party

May 7, 2024 3:54 PM

2024 Lok Sabha Elections | Why phase-3 is a tightrope walk for all parties

May 7, 2024 1:08 PM