Interest rates on home, auto and other loans are expected to come down after the Reserve Bank of India (RBI) on Friday cut benchmark interest rates for a record fifth time in a move to revive economic growth languishing at six-year lows.

Live TV

Loading...

The RBI's Monetary Policy Committee (MPC) voted to reduce the benchmark repurchase rate by 25 basis points to 5.15 percent, lowest since 2010 when the repo rate was 5 percent. Accordingly, the reverse repo rate was reduced to 4.9 percent.

After the RBI has made it mandatory for banks to align their retail loans to external benchmarks, many lenders have adopted the repo rate as the benchmark. A cut in repo rate is likely to bring cheer to borrowers.

The repo rate cut is aimed at pushing consumption up during the ongoing festival season by reducing borrowing costs for home and auto loans, which are now directly linked to this benchmark.

The RBI revised downwards its estimate for GDP growth for the fiscal year 2020 to 6.1 percent from 6.9 percent as the central bank said it sees no substantial uptick in the coming quarter.

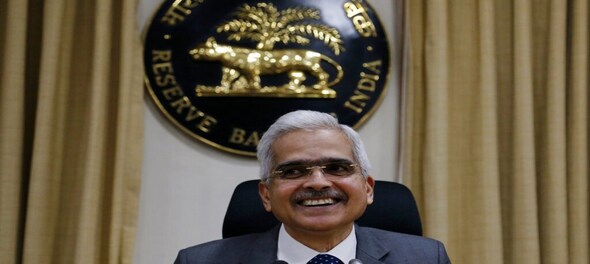

RBI Governor Shaktikanta Das said the MPC will continue with an accommodative stance as long as the growth momentum remains as it is now and growth revives while ensuring inflation remains within the target.

Since February 2019, the RBI had cut interest rates by 135 basis points whose transmission to borrowers in form of lower lending rate has "remained staggered and incomplete", the central bank said in a statement.

As against the cumulative policy repo rate reduction of 110 bps during February-August 2019, the weighted average lending rate (WALR) on fresh rupee loans of commercial banks declined by 29 bps. However, the WALR on outstanding rupee loans increased by 7 bps during the same period.

The central bank raised its near-term inflation forecast slightly to 3.4 percent for the second quarter of the fiscal started in April, while projecting it would stay below its medium-term target of 4 percent.

(With inputs from PTI)

First Published: Oct 4, 2019 2:58 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Mark Mobius reveals how markets will react if NDA wins 400+ Lok Sabha seats

May 15, 2024 8:09 PM

Wine shops and bars to remain shut for 4 days in Mumbai in 4 weeks, check details

May 15, 2024 7:52 PM

INDIA bloc will win majority seats in Bihar, says Tejashwi Yadav

May 15, 2024 4:20 PM