Saving money is not the way to build wealth, investing is. Almost every rupee you have ‘safely locked up’ in long-term FDs is barely earning a 4-6 percent interest. Well, you are not alone. More than 90 percent of household financial savings in India is parked in such ‘fixed-return vehicles.’ The problem is that this return barely keeps up with inflation, forget about building wealth! You’ve worked hard to earn your money, why let it sit idle and become worthless?

Live TV

Loading...

The simplest way to build wealth is to make your money work for you. To invest it in financial instruments that have the potential to yield double-digit returns. Historically, in the long term, participating in the growth of Indian enterprise through equity investing has given such returns. For instance:

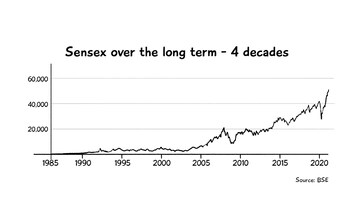

● If you had started investing in the share market in 1979, by 2021, your investment (tied to the Sensex) would have grown at 16 percent CAGR (compounded annualized growth rate).

● If you picked up some well-managed equity-oriented schemes from private sector Mutual Funds in 1993, your returns could have been about 18–20 percent CAGR.

● Investments in FDs or Gold in the same timeframe would have given you somewhere around 7.5–9 percent CAGR, depending on what you chose.

● However, if you picked up real estate in the 2000s, it’s quite likely that it’s given you negative returns since the global financial crisis in 2008.

And given India’s growth potential (see box), equities will likely yield such results for the next three decades at least.

The India Opportunity

This is a fantastic time to be an investor in India. Every decade for the last four decades — despite political, economic, communal, and technological upheavals — India’s GDP has registered a nominal (not adjusted for inflation) growth rate of 13–15 percent.

The top analysts in the world are bullish on India’s growth story. Goldman Sachs expects India to be the 2nd largest economy in the world by 2045. The International Monetary Fund (IMF) pegged an 11.5 percent growth rate for India in 2021. This makes India the only major global economy to be projected for a double-digit growth post the coronavirus pandemic.

But antiquated financial beliefs hold most of us back from investing in equities

‘I’m not going to gamble my money in stocks!’

‘My friend lost everything in the 2020 crash!’

‘It’s too much trouble to time the market!’

These are valid concerns, but they are driven more from emotion, specifically fear, than fact. Fear of the unknown, fear of unpredictability, fear of intangibility of stocks, fear of losing money. The biggest source of this fear is the perceived volatility of stocks. But if you look closely, volatility is short-term. If you change your approach to investing, and think long term, you’ll see that over a 10–15-year period the stock markets have consistently gone up.

So, what is the right approach to invest in equities?

To build wealth through equity investing you need to change the way you view them. Stocks are not about making a quick buck but about investing in a business and sticking with it. Identifying which business to invest in could be tricky though - there are after all over 5000 listed companies in India. How do you know which one is on the path to growth? That requires considerable analysis, something that individual investors don’t have the time or inclination for.

This is why the simplest way for the individual investor to buy equities is through Equity Mutual Funds (EMFs). They offer significant returns while doing the hard work of analysis and diversifying the risk of the entire portfolio. No need for you to track the market, do complex analysis, or pore over annual reports!

Investing with Equity Mutual Funds: What do you need to know

While EMFs are the best way to build long-term wealth, there are a few things you need to keep in mind:

1. Set the right goals and expectations: Think about what is the corpus you want to build and clearly define your financial goals in the short as well as long term. Understanding your income and expenditure would give you an idea of how much you would be able to put aside for investments.

2. Choose the right funds: All funds are not the same. There are several categories of Equity Mutual Funds defined by the regulator that determines where that fund can invest. Some of these restrict the ability of the scheme to diversify. For example, a sectoral fund cannot diversify in other sectors even if the sector it is aimed at is going through a low.

The key is to pick well-diversified equity mutual funds from large fund houses that invest in the right companies and are managed by experienced fund managers with a proven record in 3-4 market cycles. Going with large fund houses is always a better option since they can put together a strong team with the necessary tools required to gather the needed intelligence and also are mandated to charge less.

3. Diversify. Diversify. Diversify: Markets and industries go through cycles that impact the performance of funds invested in them. It’s prudent to further diversify your portfolio by investing in 1-2 schemes each of 3-5 fund houses to mitigate the impact of these cycles.

4. Build an investing discipline: Once you know the corpus you need to build, your saving capacity, and the funds you want to participate in; start investing regularly through a monthly Systematic Investment Plan (SIP). SIPs help reduce the volatility further and average out the cost of EMF units while helping you invest before you spend. This discipline of investing also helps build good financial habits.

5. Work with a trusted investment professional: Even with all the information at hand, it’s difficult for an individual to keep track of every little detail. An investment professional can help you understand the intricacies of the Mutual Fund industry, making investing decisions easier for you. They can also guide you through periods of short-term volatility and help you stay invested in the right EMFs. And finally, they can work with you to tie up loose ends in your investment journey such as taxation, nominations, and succession planning.

The 1 percent formula for financial freedom

Equity investing opens you to the possibility of financial freedom in your 40s. If at 25 years of age you start a monthly SIP of Rs. 20,000 in EMFs, then by the time you are 40 you’ll have a corpus of ~ Rs 1 crore In another three years, you can start withdrawing 1 percent of this corpus monthly i.e., ~ Rs 1 lakh per month while your original corpus continues to grow. This monthly stipend – a salary pension - is your ticket to financial freedom in your 40s. So don’t wait, and get started on wealth building today.

The author, Deepak Mullick, is an investment professional and author of book - ‘SimplyMutual: the 1% formula to gain your financial freedom'. The views expressed are personal

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Rapido offers free rides to voters to polling stations on May 13 in Hyderabad, 3 other cities

May 6, 2024 5:49 PM

Lok Sabha elections 2024: Seats to date, all you need to know about third phase of voting

May 6, 2024 4:49 PM

Concerns on low voter turnout a "myth"; absolute number of voters correct way to analyse: Report

May 6, 2024 2:57 PM

Haryana Lok Sabha elections 2024: A look at JJP candidates

May 6, 2024 2:26 PM