Live TV

Loading...

The fund maintains a reasonable AUM size of around Rs 8,974 crore.

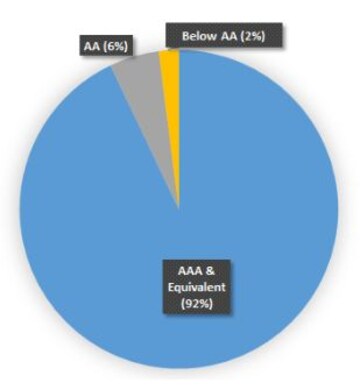

The list of non-AAA instruments that the fund has exposure to is given below.

The fact is that – most of the non-AAA rated exposure of the fund is owned either by the government or by large and well-established groups such as Tata, Aditya Birla Group and Vedanta – is a reflection of the high credit quality focus of the fund.

| Exposure to non-AAA Rated Instruments (as on October 31, 2019) | |

| AA+ & Equivalent | CANFIN Homes Ltd. (subsidiary of Canara Bank) (0.4 percent) |

| AA | Vedanta Ltd. (1.3 percent)Hindalco Industries Ltd. (a subsidiary of Aditya Birla Group) (0.5 percent)Shriram City Union Finance (0.5 percent) |

| Below AA | Coastal Gujarat Power Ltd. (a subsidiary of Tata Power) (2.5 percent)Tata Motors Ltd. (1.1 percent)Talwandi Sabo Power Ltd. (a subsidiary of Vedanta Limited) (0.6 percent)TMF Holdings Ltd. (a subsidiary of Tata Motor) (0.6 percent)Bank of Baroda (0.2 percent)Hazaribagh Ranchi Expressway Ltd. (0.1 percent) |

Adequately diversified...

The top 10 investments of the fund can be seen from the table below. From a concentration point of view, the risk is well managed as all exposures above 5% are either into PSUs promoted by the government or strong groups such as HDFC.

| Exposure of Top 10 Instruments (as on 31-Oct-19) | % of NAV |

| Power Finance Corporation Ltd. | 8.0 |

| REC LTD. | 7.1 |

| Housing Development Finance Corporation Ltd. | 6.9 |

| NABARD | 6.7 |

| Tata Capital Financial Services Ltd. | 4.8 |

| Reliance Jio Infocomm Ltd. | 4.5 |

| LIC Housing Finance Ltd. | 4.4 |

| Reliance Industries Ltd. | 4.2 |

| State Bank of India | 4.1 |

| Housing & Urban Development Corporation Ltd. | 3.6 |

With controlled duration (1-3 years) to benefit from interest rate movement...

The fund usually manages its modified duration between 1 to 3 years to take advantage of interest rate movements.

Solid track record of consistent performance...

| Returns as on Nov 22, 2019 | 1 Yr | 3 Yr | 5 Yr |

| HDFC Short Term Debt Fund | 10.4% | 7.6% | 8.3% |

| Category Average | 5.6% | 5.3% | 6.7% |

The fund despite taking lower risk has outperformed its peers consistently on a three-year rolling returns basis.

With lower risks and volatility...

As seen above the fund’s NAV movement has been stable with low volatility – reflecting the high credit quality and controlled duration.

Backed by an experienced fund management team and reputed fund house...

HDFC AMC is one of the largest fixed-income investment managers in India and has a long proven track record of performance in the high quality, low duration space.

The presence of a stable fund management team with long-standing fund manager Anil Bamboli (managing the fund since inception for the last 9 years) strengthens our conviction of the fund’s future prospects.

Summing it up

HDFC Short term fund can be considered by investors looking for 'returns above FD' with a minimum time frame of 2-3 years.

We like the fund for its large size, high credit quality, diversified portfolio, consistent performance track record with low risk and experienced fund management team.

Note: Allocation and maturity are based on the current market conditions and are subject to changes depending on the fund manager’s view of the markets. The portfolio details as on October 31, 2019.

Arun Kumar is Head of Research at FundsIndia.com.

First Published: Dec 18, 2019 6:00 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Father and son reside on same street but vote for Andhra Pradesh and Telangana separately

May 7, 2024 4:40 PM

Lok Sabha elections 2024: Radhika Khera, Shekhar Suman join BJP; meet all who are now in saffron party

May 7, 2024 3:54 PM

2024 Lok Sabha Elections | Why phase-3 is a tightrope walk for all parties

May 7, 2024 1:08 PM