HDFC Mutual Fund on Thursday, September 14, launched the HDFC Pharma and Healthcare Fund, an open-ended sectoral/thematic equity scheme. This fund aims to provide long-term capital appreciation by primarily investing in equity and equity-related securities of companies within the pharma and healthcare sector. The new fund offer (NFO) will be available till September 28, 2023.

Live TV

Loading...

The HDFC Pharma and Healthcare Fund is poised to capitalise on the growth potential of the pharma and healthcare industry. By strategically investing in these sectors, the fund aims to deliver substantial returns over the long term, the fund house said in its scheme document.

The fund's performance will be monitored against the S&P BSE Healthcare Index.

Investment amount

During NFO period, the purchase/switches can be made with Rs 100 and any amount thereafter. During continuous offer period (after scheme re-opens for

repurchase and sale), purchase/additional purchase/switch can also be done with Rs 100 and any amount thereafter.

Flexibility

Being open-ended, HDFC Pharma and Healthcare Fund allows investors to buy, sell, or switch the units on any business day at NAV-based prices, ensuring the investments are readily available when investors need them.

Load structure

While entry load is not applicable, 1 percent exit load is there if units are redeemed/switched-out within 1 year from allotment. There is no exit load after 1 year from allotment, the fund house said.

Plans/options available

Investors can choose between regular and direct plans, each offering growth and Income Distribution cum Capital Withdrawal (IDCW) Options.

Asset allocation

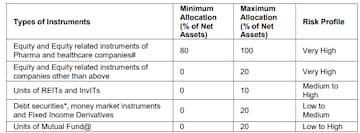

Under normal circumstances, the asset allocation of the scheme will be as follows:

(Source: Fund document)

ASBA process

Investors can apply through the Applications Supported By Blocked Amount (ASBA) process. This allows their banks to block the amount as specified in the ASBA form while they invest seamlessly.

Investment considerations

According to the fund house, the NFO offers the opportunity to combine financial growth with a contribution to the advancement of healthcare. Here are some crucial factors to consider when contemplating an investment:

Sectoral exposure: By investing in this fund, investors can position themselves to benefit from the growth potential within the pharma and healthcare industry.

Diversification: This is a fundamental strategy in investing. With this sectoral thematic fund, investors can diversify the portfolio and enhance the overall portfolio performance.

However, it's crucial to exercise prudence. Experts suggest potential investors to consult their financial advisors before making any investment decisions. Every investor's financial situation and goals are unique, and a financial advisor can provide personalised insights on whether this fund aligns with one's specific objectives.

It must also be noted that investing in pharma funds is not without risks. It's essential that investors have a comprehensive understanding of pharmaceutical companies and the dynamics of the sector. Investing in this fund essentially means taking a position in a specific industry, which can carry its own set of challenges and opportunities.

Also, the potential for growth in the pharma and healthcare sector may take time to materialise. This investment is best suited for those who can weather market fluctuations over an extended period, experts opine.

Moreover, it's important to note that the labeling and performance assessment of the fund during the New Fund Offer (NFO) stage are based on initial assessments and may evolve as investments are made.

A look at other pharma funds available

| 1. | Nippon India Pharma Fund Direct-Growth |

| 2. | Tata India Pharma & Healthcare Fund Direct-Growth |

| 3. | ICICI Prudential Pharma Healthcare & Diagnostics (P.H.D.) Fund Direct-Growth |

| 4. | Aditya Birla Sun Life Pharma & Healthcare Fund Regular Growth |

| 5. | ITI Pharma & Healthcare Fund Direct-Growth |

(Source: Groww)

First Published: Sept 14, 2023 1:20 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election: Re-elections at a Ajmer booth after presiding officer misplaces register of voters

May 2, 2024 4:54 PM

Rahul will be forced to take out 'Congress Dhoondho Yatra' after June 4: Amit Shah in Bareilly

May 2, 2024 4:36 PM