In one of our previous posts, we had reviewed a traditional plan from HDFC Life Sanchay Plus. In this post, let’s look at another popular traditional plan, HDFC Life Super Income Plan.

Live TV

Loading...

Traditional plans are opaque, provide low life cover and poor returns. Therefore, I do not hold a very high opinion of traditional life insurance plans. However, before writing off any financial product, we must still understand how the product works and get an idea of the tentative returns. In this post, let’s do just that. Let’s first try to understand the product structure and work out potential returns subsequently. We will also see how a simple combination of a term plan and PPF will fare against HDFC Life Super Income Plan.

HDFC Life Super Income Plan: Salient Features

HDFC Life Super Income Plan: Death Benefits

In the event of the demise of the policyholder during the policy term, the nominee will get:

Sum Assured on Death + Accrued bonuses + Interim bonus, if any +Terminal bonus, if any

Sum Assured on Death shall be the higher of:

Do note your policy benefits (except death benefit) are exempt from income tax only if the Sum Assured on Death (minimum death benefit) is at least 10 times annual premium. The death benefit is exempt from tax irrespective.

There are two components to this calculation of death benefit. The first component is Sum Assured on maturity: I don’t know how to calculate it but you can check this for your case on HDFC Life website. The second component is a multiple of your premium, 10 times annual premium if your entry age is up to 50 years and 7 times annual premium if your entry age is over 50 years.

If your age at the time of entry in the plan is up to 50 years, any proceeds from this insurance plan will be exempt from tax. This is because the second component of death benefit will be 10 times annualized premium.

However, if your entry age is greater than 50, there is no such guarantee. Your survival benefits and maturity benefits may well be taxed. I checked the Sum Assured on Maturity value for various combinations (for age > 50 years), but it was much less than 10 times annualized premium. Therefore, don’t bet on it to make your proceeds tax-exempt.

Do note payment of survival benefits does not impact the death benefit. For instance, whether the demise happens in the first year of pay-out period or the last year of pay-out period, the death benefit remains the same. No further survival benefits shall be paid after the demise of the policy holder.

HDFC Life Super Income Plan: Survival Benefits

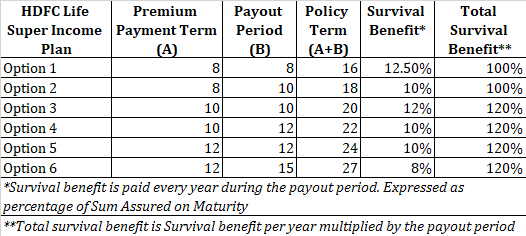

Premium Payment Term + Pay-out term = Policy Term

During the payout period, you get 100 percent or 120 percent of the Sum Assured on Maturity. The percentage depends on your variant. The benefit is spread evenly across the payout term.

HDFC Life Super Income Plan: Maturity Benefit

At maturity, you get various bonuses accrued to the policy. In addition, you get a terminal bonus, if any, at the end of the policy term.

Maturity Benefit = Accrued Reversionary Bonus (announced every year) + Interim bonus, if any + Terminal Bonus, if any (applicable only in the year of demise/maturity)

Do note, payment of last instalment of survival benefit coincides with the payment of maturity benefit.

HDFC Life Super Income Plan: Illustration

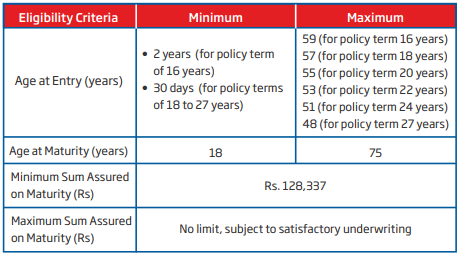

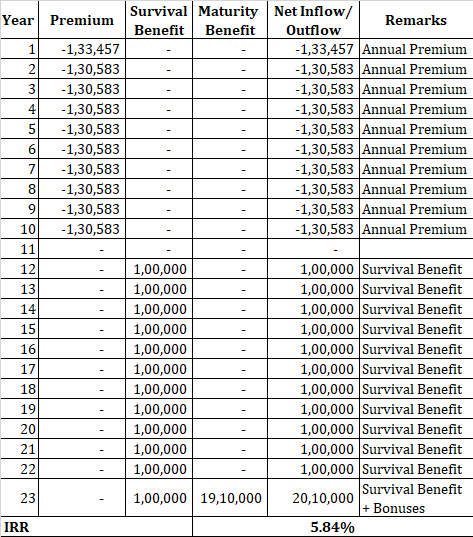

A 45-year-old person purchases Option 4 (Premium payment term: 10 years, pay-out term: 12 years, policy term: 22 years).

Sum Assured on Maturity: Rs 10 lacs

Annual premium will be Rs 1.28 lakh (before GST). After including GST, the first-year premium will be Rs 1.33 lacs and the premium for subsequent years will be Rs 1.31 lakh.

Point to Note: Sum Assured on Maturity is Rs 10 lacs while the annual premium is Rs 1.33 lakh. Clearly, Sum Assured on maturity is less than 10 times annual premium. However, the saving grace is that the entry age is 45. Therefore, the second component of Death Benefit ensures that the minimum death benefit is 10 times annual premium. This also ensures that your policy benefits will be exempt from tax. Remember, you wouldn’t have had this luxury if you were over 50 at the time of entry.

Survival Benefit: The policyholder will get 10 percent of Sum Assured on Maturity i.e. Rs 1 lakh per annum from the end of 11th policy year till the year of 22nd policy year.

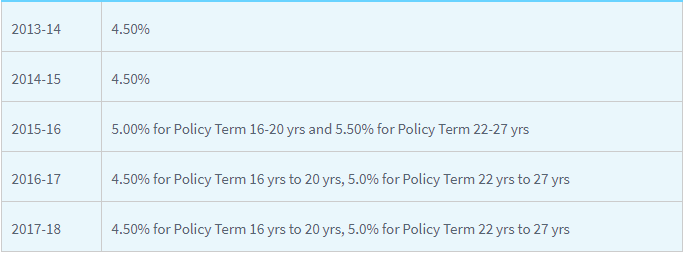

Maturity Benefit: Calculation of maturity benefit is tricky because the bonus rates are not guaranteed and are not known upfront. For the reversionary bonuses, we can go with the historical rates. Here is the data about reversionary bonus rates for HDFC Life Super Income Plan.

Let’s assume you get Simple Reversionary bonus of 5.5 percent. Reversionary Bonus is expressed as a percentage of Sum Assured on Maturity. In this case, we had chosen Sum Assured on Maturity to be Rs 10 lakh. Therefore, annual bonus will Rs 55,000 per annum. Remember, this bonus is not paid to you but gets added to the policy. You get the benefit at the time of policy maturity.

For 22-year policy term, this comes out to Rs 55,000*22 = Rs 12.1 lakh

For terminal bonus, we have no prior data. As I see, terminal bonus has not yet been announced in this policy. We will work out the numbers with some assumptions.

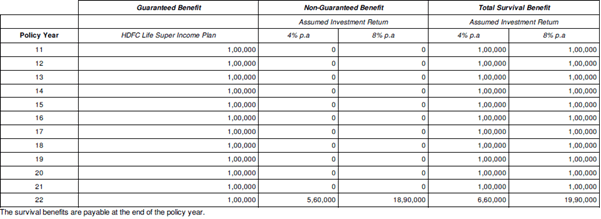

Insurance companies are required to share illustrations at 4% and 8% return on investment. For these kinds of plans, an 8% return on investment looks a fine assumption given the kind of investments that will be made. Here is a snapshot from the illustration for the same hypothetical example considered in the illustration.

It shows Rs 18.9 lakh as maturity benefit. With our assumption, Rs 12.1 lacs has already come from the reversionary bonus. Let’s say the terminal bonus is Rs 7 lakh. Therefore, the total maturity value of Rs 19.1 lakh.

Your return for this 22-year investment is 5.84 percent p.a. (with assumptions). You can expect a maximum of 6 percent p.a. By the way, the returns will be better for younger investors and worse for older investors.

The key is the insurance company were to earn 8 percent p.a. on its investments, you ill earn only 5.84 percent p.a. because of various costs including mortality charges.

If you were to keep insurance and investment separate

The same person purchases a term of Rs 50 lakh (policy term of 22 years) and invest the remaining amount in PPF. Annual term insurance premium will be Rs 13,584 (45 years, 22-year policy term).

Let’s assume you earn a return of 8 percent per annum in PPF. We further assume that you can take out money for term insurance premium payments and survival benefit (to replicate the Super income structure) every year from PPF. In the end, you will have Rs 25.5 lakh (you got only Rs 19.1 lakh in Super Income plan).

Here are additional benefits of keeping insurance and investment separate.

In short, you can avoid HDFC Life Super Income Plan. All you need is a cheap life cover, well-thought-out investments, and investment discipline. If you can’t do that, seek professional help.

First Published: Jun 14, 2019 10:28 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi voters can avail free rides from booths to their homes on polling day

May 10, 2024 6:26 PM

Kolkata North: TMC fights 'TMC' in battle reflecting party's Old vs New debate

May 10, 2024 5:14 PM