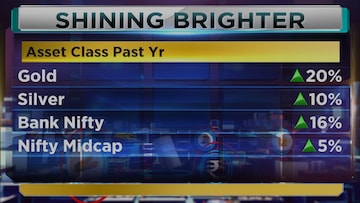

Gold and equities are both important investment avenues but they behave differently. In the current global economic scenario, gold can be seen delivering stellar returns compared to other asset classes. It recently touched a record high of Rs 61,490 per 10 grams on the Multi Commodity Exchange (MCX). On the other hand, Indian equities are also rebounding, amid weakness in the US dollar which has brought foreign institutional investors (FIIs) back into the game.

Live TV

Loading...

Given that, the question arises if investors should invest in gold which works as a hedge against uncertainty or get back to equities which have a track record of outperforming inflation over the long run.

Notably, global geopolitical tension and global banking worries have bolstered the appeal of the safe-haven metal. However, whenever equities are in an uptrend, gold gets unfavourable to traders and short-term investors.

The question remains: Is gold still a decent investment?

Jaydeep Banerjee, Co-Founder at Dvara SmartGold believes that gold will always be a good bet, particularly in light of ongoing global risks.

"Gold has consistently rallied upwards over time, and its status as a tried-and-tested investment instrument is well understood by households across India. It is important to note that 60 percent of gold consumption occurs in villages, where people have very limited access to equity markets, further solidifying gold's role as a trusted store of wealth in these areas," Banerjee told CNBC-TV18.com.

Additionally, gold's low correlation with traditional asset classes such as equities and bonds allows it to serve as a valuable diversification tool within an investment portfolio.

A low correlation, here, means that different asset types have not performed in the same way. For investors, this diversification has obvious benefits.

Banerjee thinks that this diversification can help reduce overall portfolio risk and improve long-term returns. Furthermore, gold's tangible nature makes it a reliable hedge against geopolitical tensions, economic uncertainties and potential inflationary pressures.

To understand, gold remained a decent performer of investments in the financial year 2023. The yellow metal gave a return of around 12 percent so far in the year. It still stood well, when markets were not doing good.

"On top of these, the increasing digitisation of gold investments through different platforms has made it more accessible to a broader range of investors, both in urban and rural areas. These platforms enable investors to easily purchase, sell, and manage their gold holdings, further enhancing its appeal as an investment option," Banerjee said.

The outlook

Experts believe that equities will mostly be volatile in the year due to inflation and slowdown concerns, while gold will continue to remain in focus as investors look to move towards safety.

“Gold is expected to yield good returns in FY24 as well. Inflation is coming off highs and RBI’s pause in the last policy clearly indicates their focus is on growth. While FIIs buying into the equity markets in the past few sessions is a boost for equity markets, the volatility in the equity markets will keep precious

metals an attractive space to park funds," Naveen KR, Senior Director - Investment Products, Windmill Capital and small case manager said in an earlier interaction with CNBC-TV18.com.

Rahul Kalantri, VP of commodities at Mehta Equities Ltd believes that there will be some selling pressure in the area at $2,079.75 where some profit-booking can kick in for gold.

The bottomline

Gold remains a compelling investment choice even as Indian equities rebound, due to its historical performance, innate understanding by households, and its significant consumption in villages with limited access to equity markets, as per experts. Hence, Banerjee believes that investors looking to hedge against global risks and market volatility should consider allocating a portion of their portfolio to gold.

(Edited by : Abhishek Jha)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Kannauj Lok Sabha elections: Can ex-UP CM Akhilesh Yadav reclaim this erstwhile SP bastion?

May 12, 2024 11:32 PM

Khunti Lok Sabha Elections 2024: Arjun Munda and Kali Charan to lock horns in this clash of tribal leaders

May 12, 2024 8:59 PM

Malkajgiri Lok Sabha election: A three-way contest among turncoats

May 12, 2024 8:45 PM