Gold prices dropped to a new 2-1/2-year low on Monday, weighed down by a sturdy dollar and prospects of further interest rate hikes by the US Federal Reserve to tame inflation. In recent months, the yellow metal has remained quite volatile with an upside bias as geopolitical tensions have gripped the world.

Live TV

Loading...

Inflation is still worryingly high, accompanied by a global economic slowdown that can push gold prices to a low level of $1600-1590 per ounce zone, experts say.

So, amid the current scenario when gold prices are trading lower than the historical highs, should you invest in it?

Most financial advisors say that gold should always form a small but crucial part of your portfolio.

According to Nitin Thard, Director at SafeGold, it is indeed a good opportunity for the bargain buyer to buy the dip, considering the upcoming festive and wedding season.

“Overall, the outlook for gold is positive in the long term,” he said.

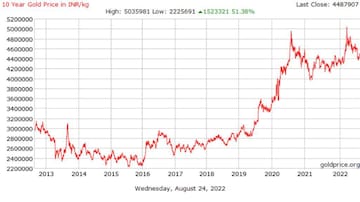

Most risk-averse investors look for safety, liquidity, and returns before investing and gold has delivered decent annualised CAGR returns in the last 10 years, making it a safe illiquid investment.

Here's how gold has performed in the last 10 years:

(Source: Bajaj Capital)

So, what should be the investment strategy?

A short to mid-term investment in gold should be fine, experts opine.

"Like any other asset class, it is difficult and futile to time the market whether it is gold or equity. So, the thumb rule for gold is to allocate up to 10 percent of your savings/portfolio in gold-related instruments and stay invested to get the benefit of appreciation in gold prices which have a tendency to catch up with inflation," said Anil Chopra, Group Director at Bajaj Capital.

On top of that, diversification is important due to the uncertain economic environment and volatility in the stock market.

For long-term financial goals, an individual needs to have adequate equity exposure, but as we know that equity investments are associated with high volatility, having investments in negatively correlated assets such as gold acts as a hedge against big swings in an equity portfolio.

Thus, you can consider investing in gold.

However, as experts say, asset class should not be looked at as a primary investment vehicle; rather it should be used for portfolio diversification purposes.

Where should you invest?

Physical gold is illiquid and digital gold can be a much better alternative. Based on the investment needs, investment horizon, risk appetite, and budget, one may choose to buy Sovereign Gold Bonds (SGBs), Exchange Traded Funds (ETFs), or Mutual Funds (MFs).

SGBs hold a clear advantage over other forms of gold investing. The price of SGBs are linked to the price of 24k gold, and the discounted price of the latest tranche of SGBs is roughly the same as the price of 24k physical gold. The interest on investment and low transaction costs make SGBs more attractive.

First Published: Sept 26, 2022 3:44 PM IST

Note To Readers

The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 35% voter turnout recorded by 1 pm

Apr 26, 2024 9:11 AM