Gold and silver rates edged higher on Thursday tracking global benchmarks, as the dollar eased from a 20-year peak in some respite for holders of other currencies. Gains in domestic equities, however, supported the risk-on sentiment of investors, limited the appeal of precious metals as an investment bet.

Live TV

Loading...

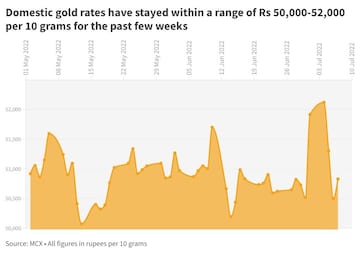

MCX gold futures — due for a delivery on August 5 — rose by as much as Rs 330 or 0.7 percent to Rs 50,830 apiece, snapping a two-day fall.

Silver followed suit, with the white metal's contract (September 5) climbing to as high as Rs 57,177 per kilogram, up by Rs 451 or 0.8 percent from its previous close.

Globally, gold rose by $2.8 or 0.2 percent to $1,742 per ounce in the spot market, and silver 0.5 percent to $19.3 an ounce.

#Gold and #Silver Opening #Rates for 07/07/2022#IBJA pic.twitter.com/39613yKHAV

— IBJA (@IBJA1919) July 7, 2022

Analysts warned that the pause in the greenback may be temporary.

The dollar index — which gauges strength in the greenback against six peers — eased 0.3 percent to 106.5, not far from a 20-year high of 107.3 hit on Wednesday.

"FOMC minutes reaffirmed that the central bank will continue with rates hikes to get inflation under control. Also supporting the price of gold are lower bond yields and worries over global growth," said Ravindra Rao, VP-Head Commodity Research at Kotak Securities.

"Gold has fallen sharply in last few days as market players preferred US dollar as a safe-haven asset. The sell-off has dented market sentiment and the general bias may be on the downside unless US dollar corrects significantly or we see a recovery in commodities at large,” he added.

Should you enter gold now?

Manoj Kumar Jain, Head-Commodity and Currency Research at Prithvi Finmart, recommends buying gold above Rs 50,500 with a stop loss at Rs 50,330 on a closing basis for a target of Rs 50,800.

He also suggests going long on silver around Rs 56,400 on a closing basis for a target of Rs 57,500 with a stop loss at Rs 55,800.

He sees support for both precious metals at the following levels:

| Support | Resistance | |

| Spot gold | $1,724-1,710 | $1,750-1,762 |

| Spot silver | $18.88-18.65 | $19.45-19.70 |

| MCX gold | Rs 50,330-50,150 | Rs 50,720-50,880 |

| MCX silver | Rs 56,200-55,800 | Rs 57,220-57,700 |

ALSO READ: Gold may not revisit 2020 peak anytime soon

The rupee gained by 20 paise to 79.10 against the greenback on Thursday, amid weakness in the US currency overseas and gains in domestic equities.

First Published: Jul 7, 2022 2:59 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

View | Congress manifesto vs BJP's wealth redistribution narrative — is it something out of nothing

May 2, 2024 9:10 AM

Two days left for filing nomination, Congress undecided on candidates for Amethi and Rae Bareli seats

May 2, 2024 7:32 AM

Lok Sabha polls: Polling time in Telangana increased by an hour, here's why

May 2, 2024 6:55 AM