The quest for higher returns often leads investors to explore various avenues, with debt mutual funds (MFs) and fixed deposits (FDs) being two of the prominent choices. Fixed deposits have long been favoured for their secure and flexible nature, while debt mutual funds gain traction due to their potential for higher returns, despite exposure to market fluctuations.

Live TV

Loading...

With both options having their set of merits and demerits, choosing one between the two can be a critical decision for investors seeking higher returns.

Talking specifically about debt mutual funds, they are designed for investors seeking moderate-risk investments with the potential for higher returns. These funds invest in a diverse portfolio of fixed-income securities, including government and corporate bonds, as well as money market instruments.

Naveen Kukreja, Co-Founder & CEO of Paisabazaar, highlights that debt funds are market-linked products, which means their returns are influenced by market conditions. He recommends fixed deposits with small finance banks offering yields of 8% and above for 2-3 tenures.

"The small finance banks have gained recognition from the Reserve Bank of India (RBI), which means their depositors are protected under the Deposit Insurance Program of DICGC, an RBI subsidiary. Some of the banks offering FD yields of 8% and above include Unity Bank, Suryoday Bank, AU Bank, Utkarsh Bank, Fincare Bank and Ujjivan Bank," he told CNBC-TV18.com.

A look at returns of FD rates of small finance banks

| Bank | Interest rates (% p.a.) | |||

| Highest slab | 1-year tenure | 3-year tenure | 5-year tenure | |

| AU Small Finance Bank | 8.00 | 6.75 | 8.00 | 7.25 |

| Capital Small Finance Bank Limited | 7.50 | 7.50 | 7.15 | 7.10 |

| Equitas Small Finance Bank | 8.50 | 8.20 | 8.00 | 7.25 |

| ESAF Small Finance Bank | 8.50 | 6.00 | 6.75 | 6.25 |

| Fincare Small Finance Bank | 8.51 | 7.50 | 8.00 | 8.00 |

| Jana Small Finance Bank | 8.50 | 8.00 | 8.50 | 7.25 |

| North East Small Finance Bank | 8.50 | 7.00 | 7.75 | 6.25 |

| Shivalik Small Finance Bank Limited | 8.10 | 8.10 | 8.00 | 7.00 |

| Suryoday Small Finance Bank | 8.60 | 6.85 | 8.60 | 8.25 |

| Ujjivan Small Finance Bank | 8.25 | 8.25 | 7.20 | 7.20 |

| Unity Small Finance Bank | 9.00 | 7.35 | 7.65 | 7.65 |

| Utkarsh Small Finance Bank | 8.50 | 8.00 | 8.50 | 7.50 |

(Source: Paisbazaar; rates as of October 12)

Bank FDs have been the go-to choice for many investors for a variety of reasons. They offer higher capital protection and income certainty compared to debt mutual funds. The interest rate for fixed deposits is known upfront, providing a level of financial predictability. Moreover, fixed deposits are renowned for their low-risk profile.

Adhil Shetty, CEO of BankBazaar.com, however, feels it is essential to acknowledge that the returns from fixed deposits tend to be lower compared to debt funds, especially over the medium to long term.

"Debt funds offer potentially higher returns compared to traditional FDs, especially over the medium to long term. However, returns are not fixed and can vary based on market conditions. Unlike traditional fixed deposits, they are subject to interest rate risk and credit risk to varying degrees," Shetty told CNBC-TV18.com.

Interest rate risk means that the value of bonds in the fund can decrease if interest rates rise, potentially leading to capital losses.

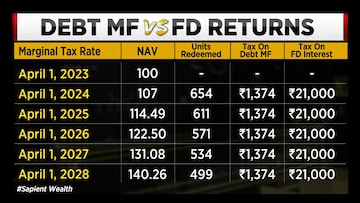

It's also important to note that debt funds no longer have the edge over bank FDs in terms of taxation as the capital gains generated from debt funds would be taxed as per the investors’ tax slabs from this financial year.

Let’s look at the differences between fixed deposits and debt funds:

| Criteria | Debt Funds | Fixed Deposits |

| Interest rates | 7%-9% | 6%-8% |

| Market dependency | Because debt mutual funds are market-linked, they depend on market variations (bonds, etc.) | Fixed deposits are not associated with the market and are unaffected by stock market volatility. |

| Risk factor | Low to Moderate risks due to market fluctuations | Guaranteed returns; minimal risk |

| Dividend option | Yes | No |

| Liquidity | HighOne can redeem debt funds anytime. However, an exit load is sometimes imposed, which varies amongst fund houses (often approximately 1%). | LowMost fixed deposit schemes allow early withdrawal with a penalty charge varying from 0.5% to 2%. However, some providers may not levy a penalty for early withdrawal. |

| Investment option | You can choose either a SIP investment or a one-time investment | You can only opt for a lump-sum investment |

| Early withdrawal | Allowed with or without exit load, depending on the mutual fund type. | A penalty is levied upon premature withdrawals. |

(Source: Groww)

The bottom line

The choice between debt funds and FDs should align with investors' financial goals, risk tolerance, and investment time frame. Also, past returns alone should not be a decision-making factor. However, there are a few considerations which investors can note:

Other options to explore

Kukreja suggests that investors having slightly higher risk appetite and investment horizons of three years or more can even consider conservative hybrid funds.

"While returns of these funds are taxed as per the investors' slab, the equity component of 10-25% in these funds allows them to generate higher returns than debt funds. Investors can consider the direct plans of SBI Conservative Hybrid Fund and HDFC Hybrid Debt Fund," he told CNBC-TV18.com.

(Edited by : Amrita)

Note To Readers

Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM