Private and public banks in India may need to raise about Rs 25 lakh crore over the two fiscals to meet the credit growth demand, a CRISIL report said.

Live TV

Loading...

About Rs 5-6 lakh crore is expected to become available through statutory liquidity ratio (SLR) fund and about Rs 20 lakh crore would be raised through fresh bank deposits, it said.

The study found that increased volatility in the equity market, moderating flows into different investment avenues and a raise in bank deposit rates in the recent months could help bring some household financial savings back into bank deposits.

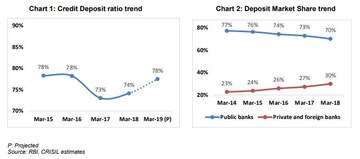

That said, the banks may raise the deposit rate on the fixed deposit (FD) accounts (FD), the report said, adding that the private banks have already gained 7 percent market share in deposits over the past five years to touch about 30 percent.

Over the past decade, the deposit growth has been declining, and in the past three years, it saw a significant drop as the interest rates offered on FD dipped below the returns on other financial investment avenues, resulting in the diversion of household financial savings away from the banks.

In its previous bi-monthly monetary policy meeting, the Reserve Bank of India (RBI) cut its statutory liquidity ratio (SLR) by 25 basis points every quarter from January-March, every calendar quarter, until the SLR reached 18 percent of the Net Demand and Time Liabilities (NTDL).

The SLR was cut in order to align it with the Liquidity Coverage Ratio (LCR) requirement. Currently, SLR stands at 19.5 percent.

SLR is the reserve requirement that the commercial banks in India are required to maintain in the form of cash, gold reserves, government-approved securities before providing credit to the customers.

The RBI is expected to announce its rate cut stance on February 7 after its sixth bi-monthly monetary policy review for 2018-19.

“CRISIL expects banks to maintain on average about 4 percent surplus SLR when credit growth picks up, compared with about 8 percent today. This, when juxtaposed with the RBI's plan to reduce the SLR limit to 18 percent by March 2020, would translate to a release of Rs 5-6 lakh crore from the SLR kitty to meet credit demand,” it added.

According to the report, banks have already utilised their prescribed SLR funds in the initial period of credit revival and would depend on the deposit growth.

“Over the first nine months of this fiscal, banks have already raised deposit rates by an average of 40-60 basis points. We expect banks to sharpen focus on deposit mobilisation over the medium term through attractive rate offerings across tenors in both bulk and retail segments,” Rama Patel, director, CRISIL Ratings said.

One basis point is a hundredth of a percentage point.

CRISIL expects the credit growth in banks to rise at a pace of 13-14 percent on average between 2019 and 2020 as compared to 8 percent in FY18, which could change the deposit mobilsation plans of banks over the medium term.

First Published: Feb 7, 2019 12:21 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: 28% of candidates contesting in fourth phase are 'crorepatis'

May 9, 2024 4:29 PM

Free poha-jalebi to movie ticket discounts: How cities struggling with 'urban apathy' are luring voters to polling booths

May 9, 2024 3:17 PM