Since its inception on January 10, 2003, the ICICI Prudential S&P BSE Sensex ETF has delivered a compounded annual growth rate (CAGR) of 17.4%. For perspective, this return means that ₹1 lakh invested at the time of inception would have grown to around ₹26.4 lakh as of December 31, 2023, ICICI Prudential Mutual Fund said.

Live TV

Loading...

In the same timeframe, the benchmark S&P BSE SENSEX TRI delivered a CAGR of 17.4%.

Given that ETFs replicate the underlying index, the difference between the benchmark index returns and the scheme return is attributed to tracking error, ICICI Prudential Mutual Fund said.

About the scheme

ICICI Prudential S&P BSE Sensex ETF with an asset under management (AUM) of ₹4,560.71 crore (December 31, 2023) has a tracking error of 0.04% (1-Year) and an expense ratio of 0.03%.

Tracking error represents how closely the scheme has been successful in replicating its underlying index.

Lower tracking error can help make the investment a balanced one.

Fund managers

The fund managers of the scheme are Kayzad Eghlim with 29 years of experience and Nishit Patel with 6 years of experience.

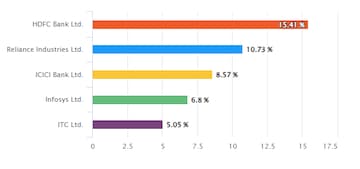

Top five holdings

(Source: ICICI Prudential Mutual Fund)

About ETFs

ETFs or "exchange-traded funds" are funds that trade on exchanges, generally tracking a specific index.

Chintan Haria, Principal- Investment Strategy, ICICI Prudential AMC said, "Over the past few years, with the rise in the number of demat accounts and market participants, the interest in ETFs have significantly improved, especially, when it comes to taking exposure to benchmark indices. This has been the result of improving investor awareness among the masses and increasing comfort around including passive strategies as a part of one’s portfolio. We believe this trend will continue in the times ahead.”

First Published: Jan 12, 2024 4:43 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Exclusive | Full text of the PM interview: Modi's agenda for the next 5 years

Apr 29, 2024 10:28 PM

PM Modi says he’s going forward with a positive attitude as a response to personal attacks

Apr 29, 2024 10:08 PM