Our definition of sustainable companies is perhaps due for a reassessment. Environmental, Social, and Governance (ESG) principles can’t be judged with a moral compass, nor can they lend themselves to rigid classifications such as good and bad ESG stocks.

Live TV

Loading...

Saints versus sinners, ethical versus corrupt, the general ESG coverage is coalescing around these themes. Investors and market analysts seem to be chiming in with their polarised interpretations of ESG.

While ESG leaders deserve to be lauded, should the perceived ‘ESG disruptors’ be viewed with absolute scepticism? Isn’t it unfair to tag certain industries with a casual term like anti-ESG?

We must be careful about having a hardliner’s approach of ‘either you are with ESG or against it’. At some level, ESG can become a touch complex. For example, how do we define sin stocks?

It’s a grey area if we assess sectors like defence. For long, defence munition and equipment found mention among sin stocks and were even absurdly compartmentalised in the same category as alcohol, gambling, and tobacco. How can an industry associated with national security be considered sinful?

Moreover, several ‘sinful’ stocks are forever in demand, driving profits during economic downturns and rewarding investors with bonuses.

Analysts cite another interesting example of carbon intensity of businesses. An organisation might reduce carbon emissions in manufacturing without control over emissions from its products and the supply chain at large.

Similarly, an industry specialising in manufacturing concentre slabs will have a high environmental impact, which is inevitable.

As they say, ‘just a single point ESG data’ might not give an accurate result of a company’s genuine ESG efforts.

ESG activists may hurl darts at tobacco and alcohol manufacturers but adults, aware of the warnings associated with these products, do exercise their free will. Sin, as they say, is a relative term. Even the best ESG-focused industries might not address climate and environmental issues. On this, there is no better analogy than electric cars that are stealing a march over diesel vehicles and rightly so. That said, lithium and cobalt, used in EV vehicles, are not necessarily environmentally friendly, for these are extracted using mining techniques.

It shows how ESG is a broad area – different industries are dependent on different resources.

There is a methodology that ESGrisk.ai has identified to classify the companies in the polluting category based on CPCB’s Red, Orange, Green and White Categories which are based on pollution index. Red being the highest polluting category with a Pollution Index Score of 60 and above. In this context Red category industries can be recognised as dirty sectors.

Interestingly, 18% of the Top 50 ESG companies are from this Red Category or the so-called dirty sector as per CPCB. Further, these top 50 ESG companies having significant portion of dirty sector are part of most of the ESG funds.

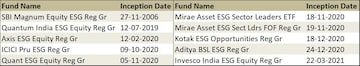

Some of the ESG funds:

Performance of the ESG funds in comparison to Nifty 50

| Return over 3 years (31/01/19 - 31/03/22) | Return over 2 years (01/04/20 - 31/03/22) | Return over 1 year (01/04/21 - 31/03/22) | |

| Nifty 50 Returns* | 76.75% | 106.86% | 21.20% |

| Returns of Top 50 ESG performing companies as per ESGRisk.ai** | 85.30% | 127.93% | 21.38% |

| *Equally weighted**Based on FY21 ESG data |

The ESG funds have beaten down the Nifty 50 both in one year and two years return

Businesses should be analysed on demonstrable ESG progress rather than how history perceives them. Environmentalists, for instance, dissect the ESG efforts of traditional sectors like oil and coal and often evaluate them critically. Like coal and oil, petroleum, atomic energy, power and steel have a significant presence in Public Sector Units (PSUs). Unfortunately, PSUs are countering negative perception regarding their ESG adherence owing to their presence in these sectors.

Somehow, PSU’s compliance with the environmental part of ESG is deemed suspect. Fact is that PSUs are gradually moving the needle on the ESG aspects of their businesses. Recent research by ESGRisk.ai across 539 private sectors and 64 PSUs revealed that Public Sector Units bettered their private counterparts in employee development and biodiversity too.

Several Indian PSUs are steadfastly moving towards solar energy, reducing carbon emissions, and demonstrating an unfailing ESG commitment. Even as institutional investors and stakeholders are demanding greater ESG accountability in all industries, Indian PSUs are growing in lockstep to meet their needs.

Coal India Ltd has already shown the way by closing its small mines. Bharat Petroleum has collaborated with the Solar Energy Corporation of India Limited to explore opportunities in the renewable energy space. Indian Oil has announced its intention of having green hydrogen to shore up its decarbonisation efforts.

Lest forgotten, PSUs remain the country’s primary source of power generation – they have to balance the centuries-old production systems with sustainability alternatives before making a complete transition to green energy.

Several Indian PSUs are already developing roadmaps for decarbonisation, which is expected to better their ESG ratings and win the confidence of private investors.

While private sectors may still enjoy an advantage over PSUs on the significant issue of greenhouse gas emissions, the difference between the ESG scores of the two, which is not glaring, is expected to reduce over time.

Lower levels of voluntary disclosures might have contributed to the difference. This could change with the Business Responsibility and Sustainability Reporting (BRSR) bringing in dynamic changes in ESG disclosures.

PSUs should be assessed with ESG frameworks, not through the smoky prism of subjectivity. Activism, sentimentalism and hysteria do not have a place in dispassionate ESG analysis.

ESG models should not act as a jury; instead, they are meant to eradicate subjective claims to arrive at objective options. Their role is not to judge but measure. These models can’t forecast the vagaries of the weather, but can certainly use analytics to measure if a company is equipped to survive unanticipated climate events.

Let’s suspend our judgment on PSUs then. In future, they could lead India’s ESG journey.

The author, Sankar Chakraborti, is Chairman at ESGrisk.ai and Group CEO Acuité Group

First Published: Nov 15, 2022 11:46 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election Phase 2: Experts decode the key trends and issues in key battleground states

Apr 26, 2024 11:53 PM

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM