Equity mutual funds have witnessed a net inflow at Rs 5,275 crore in April 2023 as against Rs 20,190 crore in March 2023, data released by the Association of Mutual Funds in India (AMFI) said. The sharp decline came in line with investors taking some profits off the table amid the rise in the equity markets. While all equity mutual fund schemes recorded net inflows in April, small-cap schemes saw the highest investments. Large-cap funds received the lowest inflows, the data showed.

Equity inflows have, meanwhile, remained in the positive zone for 26 straight months, AMFI data showed.

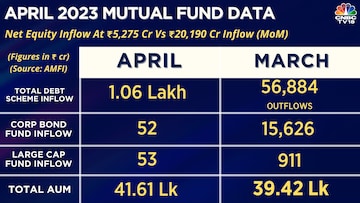

The large cap fund inflows declined to Rs 53 crore in comparison to Rs 911 crore in March 2023. Small cap fund inflows stood at Rs 2,182 crore versus Rs 2,430 crore inflows (MoM), AMFI said.

Commenting on the sharp decline, Manish Mehta, National Head and Sales, Marketing & Digital Business at Kotak Mahindra Asset Management Company said that it looks like investors have probably taken a wait and watch approach to allocating additional investments to equity in April while continuing with their existing Systematic Investment Plans (SIPs).

G Pradeepkumar, CEO at Union Asset Management Company said that April is a relatively quiet month historically after the hectic activity in March.

"So, not too much should be read into the net flows being lower compared to March. We are confident that the momentum will pick up in the coming months," he said.

According to Himanshu Srivastava, Associate Director - Manager Research, Morningstar India, investors may have chosen to be on the side-lines and wait for a more opportune time to invest into equities, given the sharp uptick in the markets seen recently.

"Conducive market environment during the month of April saw positive performance among the major indices. FIIs too have been buying into Indian equities thus contributing to the market performance. A steady decline in crude oil prices, earnings of major companies on expected lines, a potential pause on further interest rate hike and commentary by the IMF suggesting the Indian economy is expected to be grow at the fastest rate in the world were some of the positive drivers of the market during the month gone by," he said.

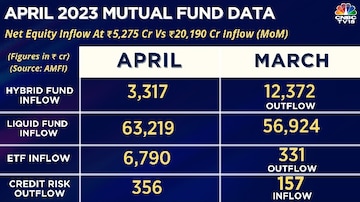

In debt category, April saw a total inflow of Rs 1,06,677.36 crore against an outflow of Rs 56,884.13 crore in March. The hybrid fund, meanwhile, saw inflow at Rs 3,317 crore, while liquid fund inflow stood at Rs 63,219 crore. The exchange traded fund (ETF) inflow was seen at Rs 6,790 crore. The credit risk outflow came in at Rs 356 crore.

The total debt scheme outflow was witnessed at Rs 1.06 lakh crore in April 2023.

On the other hand, the Systematic Investment Plan (SIP) inflows saw an inflow of Rs 13,727.63 in April 2023. The number of SIP accounts stood at 6.42 crore for April 2023 compared to 6.35 in February 2023. The marginal decline in SIP contribution is due to a higher number of holidays in April when compared to March, according to industry experts.

In addition, February's lower number of working days also led to more SIP inflows in March.

Meanwhile, the total assets under management (AUM) for the month stood at Rs 41.61 lakh crore versus 39.42 lakh crore (MoM).