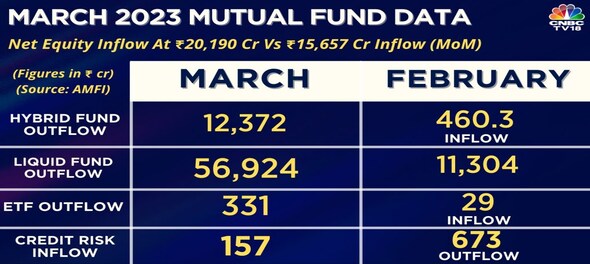

Equity mutual funds have witnessed a net inflow at Rs 20,190 crore in March 2023, data released by the Association of Mutual Funds in India (AMFI) said. This is the highest equity inflows in a year on back of continuation of robust Systematic Investment Plan (SIP) booking. In February, the same was registered at Rs 15,657 crore. The total debt scheme, on the other side, saw an outflow at Rs 56,884 crore in March versus Rs 13,815 crore outflow in February, AMFI said. This is the highest in six months.

Live TV

Loading...

The total Assets Under Management (AUM) stood At Rs 39.42 lakh crore versus Rs 39.46 lakh crore month-on-month. According to Ajay Kumar Gupta, CBO at Trust Mutual Fund, this was on the back of changes in tax laws.

"A large portion of the outflow channeled itself back into duration funds like corporate bond, banking and PSU fund, dynamic bond, long duration and gilt funds. The target maturity funds/index funds was the largest beneficiary as investors reallocated funds in the long duration funds to avail indexation benefits," Gupta said.

The hybrid fund outflow stood at Rs 12,372 crore versus Rs 460.3 crore month-on-month (MoM). The liquid fund witnessed an outflow of Rs 56,924 crore, while ETF saw an outflow of Rs 331 crore. The credit risk inflow stood at Rs 157 crore.

Arbitrage funds saw outflow of Rs 12,157.56 crore. Multi asset allocation witnessed an inflow of Rs 473.22 crore and conservative hybrid fund saw an inflow of Rs 282.86 crore.

The small cap fund inflow stood at Rs 2,430 crore versus Rs 2,246 crore inflow month-on-month. The midcap fund inflow came in at Rs 2,129 crore versus Rs 1,816 crore inflow month-on-month. The dividend yield fund inflow stood at Rs 3,716 crore versus Rs 42 crore inflow.

The large cap fund inflow stood at Rs 911 crore.

On the debt side, corporate bond fund saw an inflow of Rs 15,626 crore versus Rs 662 crore in February.

In the growth/equity oriented funds, all the 11 categories saw positive inflows. In the category, thematic funds saw the highest net inflows at Rs 3,928.97 crore.

The SIP amount has also hit an all-time high of Rs 14,276 crores in March. According to G Pradeepkumar, CEO at Union Asset Management Company Pvt. Ltd, this reinforces the belief that domestic investors continue to have a high level of confidence in the Indian growth story and also in mutual funds as an effective vehicle for wealth creation.

Meanwhile, 20 new fund offers (NFOs) were launched in 1 month, taking total amount from NFOs at Rs 8,496 crore.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM