The total number of new demat accounts opened in December 2023 reached a historic high of 42 lakh. With this, the number of demat accounts in India now stands at 13.93 crore. This is a 50% surge compared to November, which saw 28 lakh new demat accounts.

Live TV

Loading...

The consistent rise in account openings is indicative of the growing investor interest and participation in the financial markets, experts say.

"The recent surge in the market has triggered a fear Of missing out (FOMO), prompting individuals to join the market rally to avoid being left behind. Optimism prevailed further concerning the possibility of rate cuts by the US Federal Reserve in the coming months, influencing investor sentiment and driving them towards market participation," ICICI Direct said in a note.

Additionally, the success of various initial public offerings (IPOs) has lured in new investors eager to capitalise on these opportunities.

The returns observed in the small- and mid-cap index throughout 2023 further fuelled investor enthusiasm, serving as an additional incentive for new entrants to the market, it said.

More numbers

If we talk about financial year 2022-23, there was an addition of 2.5 crore demat accounts, with a monthly average of over 20 lakh.

The statistics also revealed a significant uptick in demat accounts opened with the two major depositories — the Central Depository Services (CDSL) and the National Securities Depository (NSDL) in FY23.

Over the 12 months of FY23, the number of accounts surged by 27%, rising from 8.97 crore to 11.446 crore.

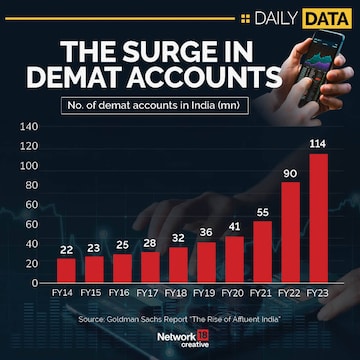

Looking back at the trend in recent financial years, the growth is evident.

In the financial year 2021-22 (FY22), the number of demat accounts stood at nine crore. This marked a substantial increase from FY21, which recorded 5.5 crore accounts.

Going further back, in FY14, there were 2.2 crore accounts, and the subsequent years witnessed a steady climb — 2.3 crore, 2.5 crore, 2.8 crore, 3.2 crore, 3.6 crore, and 4.1 crore in FY 15, FY16, FY17, FY18, FY19 and FY20, respectively.

(Edited by : Shoma Bhattacharjee)

First Published: Jan 15, 2024 6:02 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP replaces Poonam Mahajan with lawyer Ujjwal Nikam for Mumbai North Central Lok Sabha seat

Apr 27, 2024 7:53 PM

Meet Amritpal Singh, the separatist leader contesting Lok Sabha polls from Punjab's Khadoor Sahib

Apr 27, 2024 7:18 PM