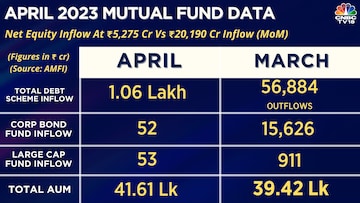

Debt mutual funds witnessed a sharp turnaround in April as they received a huge net inflow of Rs 1,06,677 crore. Except for credit risk and banking and PSU fund categories, all the other categories witnessed net inflows. This came after the category received a massive outflow of Rs 56,884 crore last month,

Live TV

Loading...

Expectedly, categories having shorter maturity profile were the biggest beneficiaries. Liquid funds received the highest net inflows during the month followed by money market fund and ultrashort duration fund category.

Liquid funds are preferred by investors to park their money for short periods of time. They invest predominantly in highly liquid money market instruments and debt securities of very short tenure and hence provide high liquidity.

While liquid funds saw an inflow of Rs 63,219 crore, money market fund witnessed Rs 13,961 crore inflow in April. The ultrashort duration fund saw inflow of Rs 10,661 crore.

Credit-risk funds recorded outflows of Rs 356.12 crore in April.

"After meeting the tax liabilities of the last financial year in March, corporates would have parked their excess investible money in liquid fund and ultra short duration fund categories, for a short period, thereby leading to huge inflows in these categories," said Himanshu Srivastava, Associate Director, Manager Research at Morningstar India.

ALSO READ | HNIs preferring fixed deposits over debt mutual funds, retail SIP traction strong: Motilal Oswal

"Also, investors would have preferred to invest in categories with shorter maturity profile such as low duration, money market and short duration funds since there is still some degree of uncertainty over the direction that RBI could take with respect to interest rates going ahead. Floater funds also received good net inflows given their ability to withstand changing interest rates scenario," he added.

According to Mayank Bhatnagar, Chief Operating Officer at FinEdge, huge inflows buoyed the share of fixed income funds in the overall share of AUM on a month-on-month basis.

"While March’s outflow was a natural and expected yearend phenomenon. It is difficult to ascertain the reason behind this sudden about turn in liquid fund inflows," he said.

Rajiv Bajaj, Chairman and MD at Bajaj Capital said that the increase in inflow in debt could be attributed to the RBI’s decision in the last monetary policy meeting to hold the policy rates (repo rate).

"It has given the confidence to the investors that interest rate risk is now mitigated and it is time to lock in the higher yields. It is worth remembering that the yield curve has moved up sharply during the last 1 year once the RBI has started tightening its monetary policy," he said.

Meanwhile, the total assets under management (AUM) for the month stood at Rs 41.61 lakh crore versus 39.42 lakh crore (MoM).

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Rapido offers free rides to voters to polling stations on May 13 in Hyderabad, 3 other cities

May 6, 2024 5:49 PM

Lok Sabha elections 2024: Seats to date, all you need to know about third phase of voting

May 6, 2024 4:49 PM

Concerns on low voter turnout a "myth"; absolute number of voters correct way to analyse: Report

May 6, 2024 2:57 PM

Haryana Lok Sabha elections 2024: A look at JJP candidates

May 6, 2024 2:26 PM