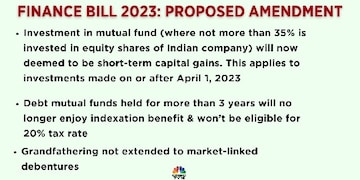

In a setback for debt mutual funds, the government has proposed in Finance Bill that investment in mutual fund where not more than 35 percent is invested in equity shares of Indian company will now be deemed to be short-term capital gains. This will apply to investments made on or after April 1, 2023. Also, debt funds held for more than three years will no longer enjoy indexation benefit. Additionally, they won't be eligible for 20 percent tax rate.

Live TV

Loading...

Grandfathering will also not be extended to market-linked debentures.

Experts say that these changes are proposed to bring bank fixed deposits on-par with debt mutual funds.

"Amongst the main reasons to invest in debt, gold and international funds was because of the indexation advantage. Retail investors are not that big in the fixed income category including target maturity fund's hence it's the international clients that will get impacted more and HNIs," industry experts say.

Radhika Gupta, Managing Director and Chief Executive Officer at Edelweiss AMC said that this will have an adverse impact.

"Debt funds is a big part of our portfolio. They have been able to channel significant amount of money in bond market. Bond market liquidity has been a concern in India for a long time money could migrate to fixed deposits. This will impact only the long-term investment in debt funds," she told CNBC-TV18.

According to an insurance analyst, this amendment is a googly as the entire focus was on whether or not the life insurance non-linked limit of Rs 5 lakh will be increased or indexation benefits given and the amendment brought changes to debt funds.

"This means that life Insurance products better are than debt MF (from taxation perspective) for an annual investment up to Rs 5 lakh. In above Rs 5 lakh annual investment, life Insurance and debt MF are at parity, a case better than what was the scenario post budget FY24," the analyst told CNBC-TV18.

Currently, investors in debt funds pay income tax on capital gains according to their income tax slab for a holding period of three years and after that, they are taxed at the rate of 20 percent with indexation benefits or 10 percent without indexation.

First Published: Mar 24, 2023 8:42 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi Congress chief Arvinder Singh Lovely resigns

Apr 28, 2024 10:54 AM

Lok Sabha polls: Voter turnout in Rajasthan over 62%, down by 4% since 2019

Apr 28, 2024 8:49 AM