Investing in a debt mutual fund is not as much a mystery as it is made out to be. To expand the base of investors, particularly in the retail segment, it is important that knowledge is imparted in the most simple and direct form to garner their conviction for participation.

Live TV

Loading...

Out of the total assets under management of fund houses, individual investors predominantly hold equity-oriented schemes. Only 15 percent of the assets are held in debt-oriented schemes.

As of March 31, 2022, banks had total deposits of Rs 170 lakh crore whereas individual investors’ investments in debt mutual funds stood at Rs 3.5 lakh crore.

The debt schemes provide advantages like indexation benefits and risk-adjusted returns.

Basics of bond

Unlike equity MF, future returns in the debt segment can be estimated as follows:

Estimated returns in debt MF = Portfolio yield – expense ratio + capital gain/loss due to rise/fall in bond prices.

Bond prices will appreciate due to:

–Fall in yields of the underlying asset (not the repo rate)

–Rise in the credit quality of underlying asset

Generally, to generate higher yield-to-maturity (YTM), the fund manager must take two types of risk in the bond market:

–Duration risk by purchasing long-duration bonds

–Credit risk by purchasing low asset quality securities

Currently, the payoffs in duration risk may be attractive because of the following reasons:

The Macro Impact

Macro-economic factors like easing of commodity inflation, yield inversion and softening of 10-year government securities(G-sec) in the developed world play an important role in the movement of yields in the Indian bond market.

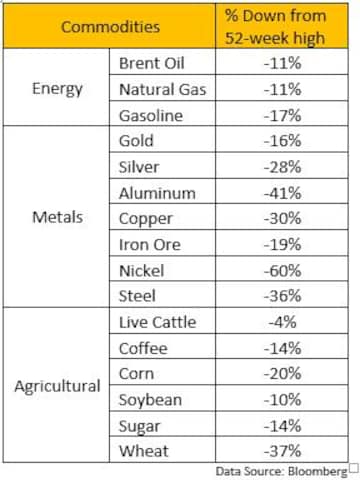

1) Due to fears of a recession, prices of commodities may soften on anticipations of demand weakening, which in turn may cool down inflation. As inflation slows, the central bank might taper down any hawkish stance. We have already witnessed a fall in commodities prices as indicated in the following table (prices as of July 28, 2022):

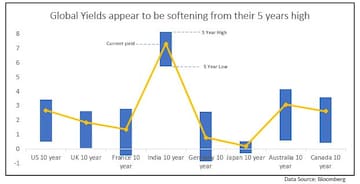

2) With the fear of recession gripping the developed world, there is a tendency for yield inversion. Meaning short-term yields rise while long-term yields soften.

3) Developed countries' 10-year government securities yields may have peaked around June 15 and appear to be softening as they are moving down from their 5-year high.

The Spread Impact

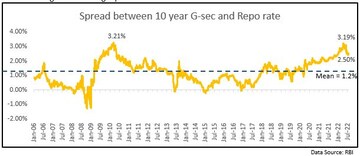

Generally, higher spreads are one of the good indicators of buying debt securities as there are chances of mean reversion happening which may result in rise in the bond prices.

1) Spreads between 10-year G-sec and repo rate is at 2.5 percent (mean = 1.2 percent). This gives a buffer of 1.3 percent against the rising repo rate.

2) Credit spreads are currently narrow as compared to their historical average leaving very little room for further compression.

3) Currently, the long-duration securities of 10 years and above have YTM > 7.3 percent. If the bond yields fall, the fund with a higher modified duration may generate higher returns because of the inverse correlation between bond prices and bond yields.

Indexation benefit – The differentiating factor of debt funds

Long-term capital gains from debt MF also have indexation benefits. Listed below are the tax benefit one can avail of by investing in debt MFs as compared to the traditional investment products that don’t have such benefits.

**Above is for illustrative purpose only. Consult your tax advisor before investing for taxation. The tax rate assumed is the highest rate based on the current tax slabs for individual/HUFs with income above Rs 5 Crore. For domestic corporate corresponding tax rate applicable would be 34.94% for interest on term deposits and 23.30% for long term Capital gains for open ended debt funds. Indexation cost assumed @ 6% p.a. Tax includes 4% Education & Health cess and 37% Surcharge

**Above is for illustrative purpose only. Consult your tax advisor before investing for taxation. The tax rate assumed is the highest rate based on the current tax slabs for individual/HUFs with income above Rs 5 Crore. For domestic corporate corresponding tax rate applicable would be 34.94% for interest on term deposits and 23.30% for long term Capital gains for open ended debt funds. Indexation cost assumed @ 6% p.a. Tax includes 4% Education & Health cess and 37% SurchargeHistorical perspective

In 2008, the 10-year G-sec yield peaked before the repo rate was at its highest in that year. Waiting for the repo rate to peak and investing may not be an ideal strategy as the market has already factored in future rate hikes.

Conclusion: So, if one has an investment horizon of 3-5 years, taking duration risks may generate better payoffs and hence long duration funds may be an ideal investment solution.

The author Ashish Patil is Head - Product and Strategy at LIC Mutual Fund Asset Management Ltd. Views expressed are personal.

First Published: Aug 4, 2022 1:54 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

In Andhra's Pithapuram, its Pawan Kalyan's charisma vs YSRCP MP Geetha's credentials

May 8, 2024 10:23 AM

Lok Sabha elections: 3rd phase sees over 65% voter participation, Assam leads with 81.71% turnout

May 8, 2024 1:00 AM

Telangana CM violated poll code, defer Rythu Bharosa payment, says Election Commission

May 7, 2024 9:01 PM

Lok Sabha Election 2024: How Indian political parties are leveraging AI

May 7, 2024 6:59 PM