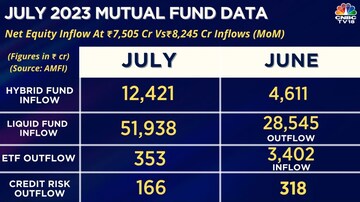

The Association of Mutual Funds in India (AMFI) data on Wednesday showed that debt-oriented schemes in the mutual fund sector received a net inflow of Rs 61,400.08 crore during the month of July. However, a closer look at the data reveals a mixed picture, with certain categories witnessing net outflows while others experienced substantial inflows.

Live TV

Loading...

Among the categories that faced net outflows were overnight funds, short duration funds, medium duration funds, credit risk funds, banking and PSU funds, and gilt funds with 10-year constant durations. Overnight funds stood out as the category with the highest net outflows, amounting to Rs 10,746.83 crore in July. This marked a significant reversal from June's inflow of Rs 4,627.93 crore in the same category.

Himanshu Srivastava, Associate Director - Manager Research at Morningstar India, attributed this phenomenon to investors reallocating their funds from these categories to better-performing assets such as equities. He pointed out that these funds often serve as temporary parking spaces for short-term capital, leading to their volatile flows.

On the other hand, categories like liquid funds registered substantial inflows, with Rs 51,938.41 crore pouring in during July, a remarkable turnaround from the Rs 28,545.45 crore outflow in June. Srivastava explained this as a common practice among corporates and institutions to invest excess short-term capital in liquid funds after the end of a quarter.

Srivastava also emphasized the cautious approach of investors in light of the prevailing interest rate scenario and uncertainty over their future direction in the country. He noted that many investors favored categories with a maturity profile of one year or less, given their lower interest rate risk.

The dynamic bond fund category, however, witnessed the lowest inflow within the debt mutual fund category, receiving a relatively modest inflow of Rs 67.38 crore. Banking and PSU funds experienced an outflow of Rs 1,309.95 crore during the same period.

Srivastava identified two distinct investor strategies in response to the shifting landscape. One group leaned towards higher risk, investing in categories like gilt funds, dynamic bond funds, medium to long-duration funds, and long-duration funds in anticipation of a potential change in the interest rate cycle. These categories are poised to benefit if the interest rate cycle reverses, although they carry higher interest rate risks. Conversely, categories that took credit bets, such as Credit Risk and Medium Duration, struggled to attract investor attention in July.

As the uncertainty surrounding interest rates continues, investors appear to be carefully navigating their choices, aiming to strike a balance between risk and potential rewards.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

In Ayodhya, voters talk of a promise fulfilled and yearning for development

May 17, 2024 2:10 PM

Fight of heavyweights in Sambalpur where farmers, weavers hold the key

May 17, 2024 12:25 PM

Odisha: Fight of heavyweights in Sambalpur where farmers, weavers hold the key

May 17, 2024 10:22 AM

Lok Sabha Election 2024: What rural Delhi wants

May 16, 2024 10:10 PM