The Reserve Bank of India's (RBI's) data has recently shed light on a concerning trend in India's payment ecosystem. While Unified Payment Interface (UPI) transactions soared by 46% year-on-year (YoY) in November, a stark contrast emerged with the decline of debit card transactions, which contracted by 6.6% YoY in October.

Live TV

Loading...

This steep drop in debit cards use has sparked discussions about the evolving preferences in digital payments across the nation.

The data speaks

In value terms, the disparity is even more apparent, with UPI transactions settling at ₹17 lakh in November.

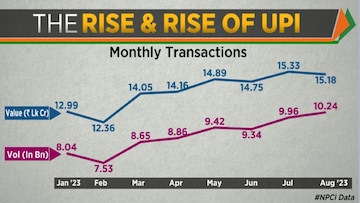

The growth in UPI use in India in recent months.

The growth in UPI use in India in recent months.Debit card transactions, on the other hand, is just a third of the amount settled through UPI during the month.

Shifting landscape

The growth of UPI is the main reason why debit card transactions have fallen as people now prefer to use their phones to pay rather than swipe a debit card.

Atish Shelar, COO of Tech Fini, a financial software provider, highlighted the rapid evolution of the digital payment landscape.

Shelar pointed out the popularity of mobile wallets, contactless payments, and online platforms as significant influencers in this shift.

"While debit cards have long been a staple, there's a noticeable inclination towards alternative payment methods among consumers," he told CNBC-TV18.com.

He added that 114 billion digital payments were recorded across India in financial year 2023. Out of this, 52% of the households used the UPI platform. On the other hand, only around 38% of the households used debit or credit cards when shopping online.

Security concerns, shifting consumer preferences, and the advent of fintech innovations have also played pivotal roles. The convenience and ease of UPI for microtransactions have particularly contributed to the declining relevance of debit cards.

Further, the adoption of UPI in semi-urban and rural areas has seen a staggering surge, with transactions in retail stores increasing by 118% in volume and 106% in value.

A report from PayNearby, a branchless banking and digital network platform, highlights the growing penetration of UPI beyond tier-II regions. Moreover, the acceptance of mPOS (mobile point-of-sale) has seen a 5% growth. This shows increased technological integration among small merchants.

Debit card issuance and alternative trends

While banks issued a considerable number of debit cards following the Pradhan Mantri Jan Dhan Yojana (PMJDY), which provided account holders with a debit card, the growth trajectory remains flat.

In contrast, credit card usage has witnessed an upward trend, possibly attributed to the lure of rewards, cashback, and discounts.

Payment through credit cards also gives the user a free grace period to pay or go for an instalment option. They are mostly preferred for large ticket transactions.

The bottom line

Considering the current momentum, it's plausible that this trend may persist into the upcoming year.

Factors such as the convenience, security, and incentives offered by UPI and credit cards continue to push users away from traditional debit card usage.

Additionally, the rapid advancements in fintech and the growing penetration of digital payment solutions in rural and semi-urban areas might further accelerate the decline of debit card transactions. Unless there's a significant overhaul in the offerings or a marked shift in consumer preferences, the downward trend in debit card usage might likely extend into 2024, experts say.

(Edited by : Shoma Bhattacharjee)

First Published: Dec 28, 2023 5:40 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!