TransUnion CIBIL has released findings from the latest edition of its Credit Market Indicator (CMI) report, which shows that credit demand in the third quarter ending September 2022 remained robust, with a corresponding increase in originations as lenders continued to provide credit opportunities for millions of consumers across India. Consumption-led lending fueled growth amid positive lender sentiment, with credit performance showing consistent improvement year-over-year (YoY).

Live TV

Loading...

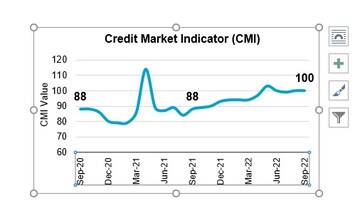

The CMI, which provides India’s credit industry with a reliable and contemporary benchmark of retail lending health, reached a level of 100 in September 2022, with younger consumers driving demand and lenders catering to the supply of credit to these consumers. The latest CMI reports that, for the first time, consumers from the 18-30 year-old age group accounted for the largest proportion of inquiries—a measure of consumers applying for new credit— in the quarter ending September 2022.

This trend is underlined by rapid growth in consumption-led credit products like credit cards, consumer durable loans and personal loans.

“The fact that 43 percent of retail credit inquiries were made by consumers in the 18-30 year old age group, compared to 38 percent in the same quarter in 2021, and 33 percent in the year before, indicates a major milestone in the evolution of India’s credit market, which now has stronger participation of younger consumers in the credit ecosystem,” said Rajesh Kumar, Managing Director and CEO of TransUnion CIBIL.

“Increased access to credit opportunities for younger borrowers has direct correlation to improvement in the quality of life and financial empowerment of India’s youth, who are the drivers of the country’s economic engine," he said.

Monthly CMI (September 2020 to September 2022)

The most demanded credit products in the third quarter ending September 2022 were personal loans, followed by credit cards. Inquiry volumes for personal loans increased by 109 percent YoY, compared to a growth rate of 91 percent in the same quarter in 2021, while inquiry volumes for credit cards increased by 102 percent YoY, compared to a growth rate of 33 percent in the corresponding quarter one year before, the report said.

Demand and supply of consumption-led credit products are intrinsically digital in construct. Lenders are swiftly embracing digital processes to reach consumers across India’s geography, providing them access to credit through digital channels, the report said.

Analyses of the CMI at a geographic-level shows that credit reach has expanded in regions that were historically underserved. For instance, Uttar Pradesh has shown the strongest improvement in credit health with a CMI value of 102, an improvement of 19 points YoY.

Overall loan originations of retail loans in Uttar Pradesh comprised just over a quarter (26 percent) that were provided to new-to-credit (NTC) consumers.

Credit penetration in Uttar Pradesh is steadily increasing, reaching 13 percent in the quarter ending September 2022 from 11 percent during the same period in the previous year. Uttar Pradesh’s share of consumer durable loans has grown to be 9 percent of all loans of this type across India, which is an increase of five percentage points compared to the same quarter in 2019.

Borrower profiles shift across age groups and location

A continued feature of the retail credit evolution has been increased credit penetration. Over the last three years, between September 2019 and September 2022, credit penetration has improved across age groups. Consumers in the 18-30 years age group who have availed at least one credit product increased from 14 percent to 19 percent; in the 31-45 year age group, it increased from 26 percent to 35 percent; and from 23 percent to 32 percent among the 46+ year cohort.

From a location perspective, most inquiries (31 percent) still come from metro areas, but this proportion is slowly declining. Conversely, the number of inquiries emanating from rural areas has increased by one percentage point each year, from 20 percent in September 2020 to 22 percent of all inquiries in September 2022. Inquiries from urban and semi-urban areas have remained consistent at 21 percent and 26 percent respectively over the last three years.

“Growth and demand continue to come from younger consumers, and those who have historically been unable to experience the benefits of financial inclusion due to their location, or their lack of connectivity,” Kumar said.

“This is also likely due to an improvement in economic activity that has resulted in a continued growth trajectory for credit demand across India, which is currently at a three-year high," he added.

Credit supply continues to grow in line with the growth in demand, with semi-urban and rural consumers accounting for 56 percent of originations, and younger consumers (18-30 years age group) accounting for 37 percent of originations – an increase of six percentage points YoY.

Analysis of the latest CMI also shows a marked improvement in borrower profiles, with nearly one-third (32 percent) of consumers holding a prime credit score, up four percentage points from the same period in 2021. Over the same time, 38 percent of near-prime consumers improved their status to prime in Q3 of 2022.

Importantly, while credit demand and outstanding balances increased, credit performance has remained strong, with balance-level delinquencies improving YoY in September 2022 across all major credit products.

YoY Growth in Outstanding Balances (September 2022)

| Product | Value |

| Home Loan | 15% |

| Loans Against Property | 7% |

| Auto Loan | 18% |

| Two Wheeler Loan | 16% |

| Personal Loan | 32% |

| Credit Card | 28% |

| Consumer Durable Loan | 67% |

(Edited by : Anshul)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Interview | PM Modi targets Naveen Patnaik and BJD — asks Odisha a chance for BJP

Apr 28, 2024 7:53 PM

PM Modi says great men like Nehru and Ambedkar were against reservation based on religion

Apr 28, 2024 6:41 PM

Exclusive | Congress has turned Bengaluru from 'tech hub to tanker hub': PM Modi

Apr 28, 2024 6:18 PM

Modi Interview | Here's what the Prime Minister said on inheritance tax

Apr 28, 2024 6:05 PM