The claim settlement ratio for life insurance slightly decreased in 2022-23 to 98.45%, compared to 98.64% in 2021-22, according to the Insurance Regulatory and Development Authority of India (IRDAI) annual report. This decrease is mirrored in both the public and private sectors, with Life Insurance Corporation (LIC) settling at 98.52% (down from 98.84%) and private counterparts marking 98.02% (a slight drop from 98.11%).

Live TV

Loading...

The health insurance sector, however, revealed a different narrative.

While general and health insurance companies settled 85.66% of claims based on policy count, the amount paid out was lower at 71.62%.

The claim settlement ratio, often considered an important metric while buying any policy, shows the percentage of claims the insurance company has paid out during a certain period.

The ratio is determined by dividing the total number of claims approved by the number of claims received by the insurance company.

For example, if the life insurance provider received a total of 100 death claims and settled 90 of them, then the claim settlement ratio is 90%.

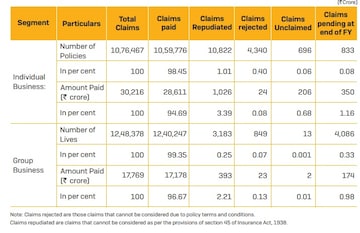

Actual death claims of life insurers

(Source: IRDAI annual report)

A higher settlement ratio is proportional to a company’s honour of commitments made at the time of purchase. It gives assurance that the promise will be kept at the time of need, insurance experts believe.

The claim settlement ratio also portrays the underwriting processes that the company follows.

Underwriting is the process of evaluating an insurance application that includes determining applicants' risk by reviewing their medical and financial information.

Here's a look at quarterly claim settlement ratios of a few life private insurance providers:

| Life Insurance Company | Claim Settlement Ratio Q2- FY2024 | Claim Settlement Ratio Q1- FY2024 |

| ICICI Prudential Life Insurance | 98.14% | 97.9% |

| TATA AIA Life Insurance | 90.55% | 77.3% |

| HDFC Life | 96.62% | 96.7% |

| Bajaj Allianz Life Insurance | 91.79% | 93.5% |

| Max Life Insurance | 95.90% | 86.3% |

| SBI Life Insurance | 95.67% | 95.8% |

(Source: Public disclosure available on company’s website)

(Edited by : Shoma Bhattacharjee)

First Published: Jan 1, 2024 6:34 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | What does a low voter turnout indicate for NDA and I.N.D.I.A Bloc

Apr 29, 2024 5:48 AM

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM